Monthly Market Update

Monthly Market Updates – Shooting It To You Straight!

Welcome to our Monthly Market Update where our Realty Aces team provide unfiltered opinions, statistics and insights into the local real estate market.

Get Free Monthly Market Updates

June 2025 Market Update

| Hi Friends, |

Slowly the general public is becoming aware and accepting that we are now in a new real estate market in 2025, keyword is “slowly”.

The reality is that change in the market can be quick, however it takes time for buyers and sellers to grasp how to operate within and understand a new market. Therefore, I am going to focus this newsletter on breaking down our current market and how I feel it can successfully be navigated, let’s go!

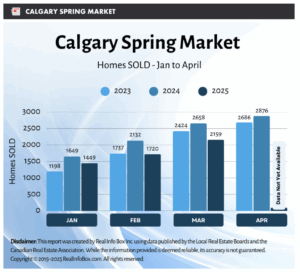

As an example residential sales year over year in Calgary eased by 17 per cent compared to May of last year and remember that it was 22% in April and 19% in March – the trend continues! As sales volume slows it’s important for sellers to ensure they’re the Belle of the ball when they hit the market if they want to succeed.

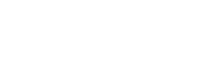

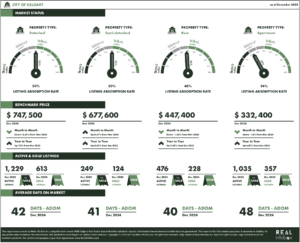

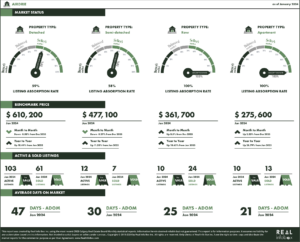

The market is fragmented at the moment and what I mean by this is that each home type is performing differently in different sub markets and communities as you will notice on the market statistics below. Additionally some communities are still in a sellers market while others are experiencing a major price adjustment at the moment.

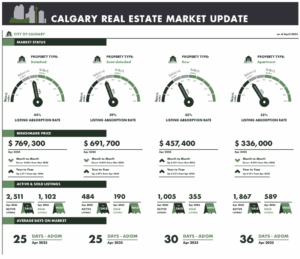

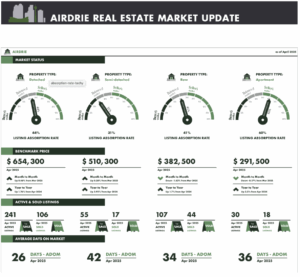

For example, there is a lack of supply of properties in West Calgary, meanwhile Airdrie and Cochrane now have an oversupply. Some price points are performing better than others and especially the higher/luxury price points in Calgary or acreages in general, meanwhile it’s slowing drastically within smaller communities such as Airdrie.

The takeaway is that no market is alike and to generalize the status of this new market as only “balanced” is tough because many communities are a buyer’s market and have 10-20% of properties selling each month, while others are 60%+.

This market reminds me of our market pre-covid and the key to succeeding in 2018/2019 was truly understanding the data and getting ahead of the curve to find opportunity for buyers and sellers. In many cases using data that is 30-45 days old is no longer relevant depending on the location because May has experienced some major price adjustments across most of the board.

Personally I really enjoy this market because I feel like I can see where the market is and where it is heading, so it’s easy to give solid real estate advice to my clients. Although the truth of the market can be hard to swallow for some clients depending on their real estate position, at least it’s the truth and that is always received well!

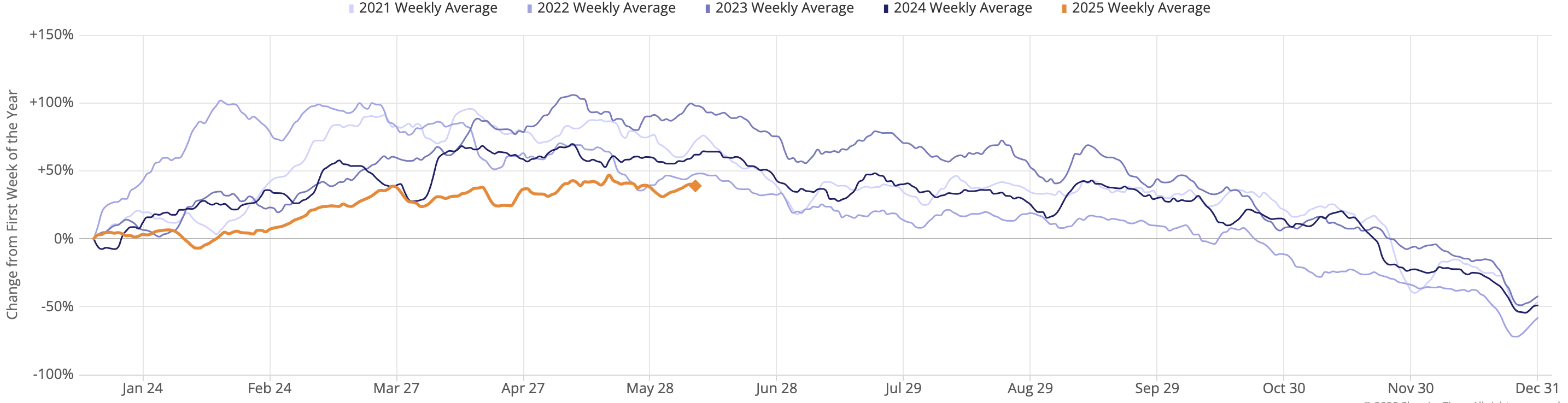

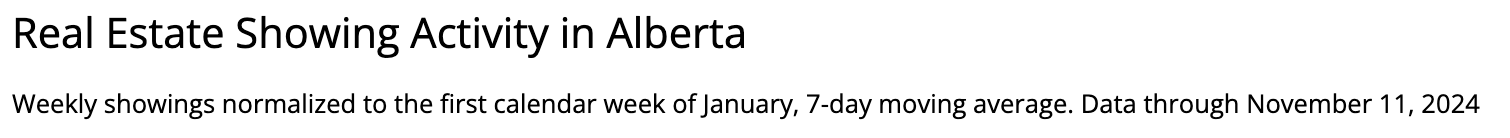

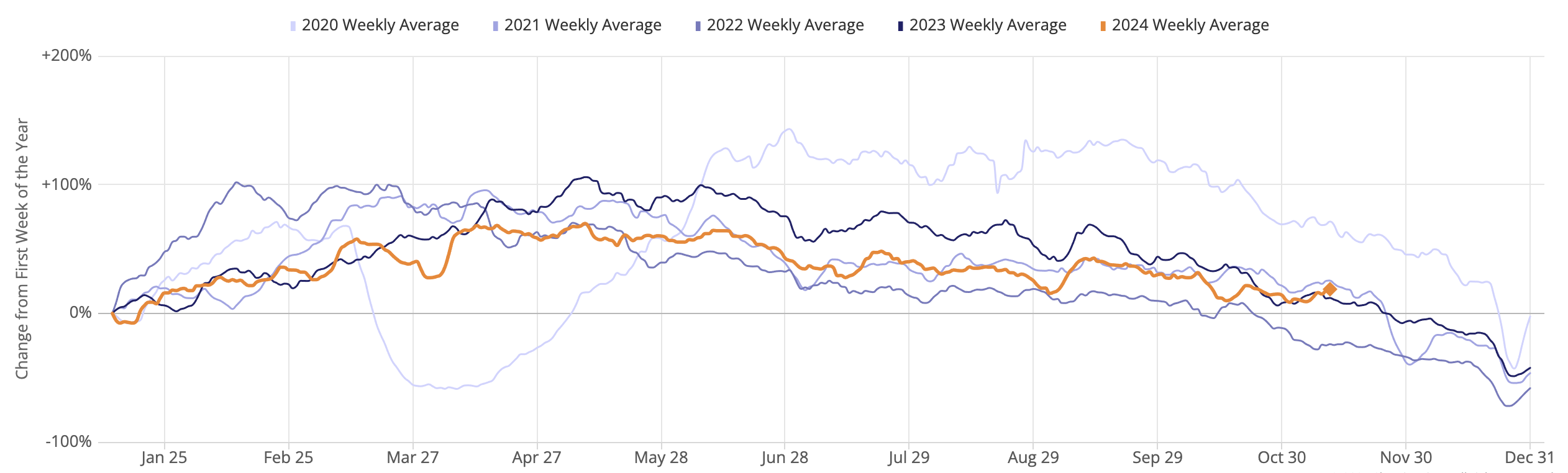

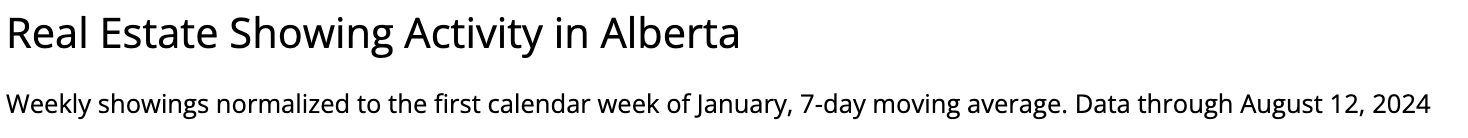

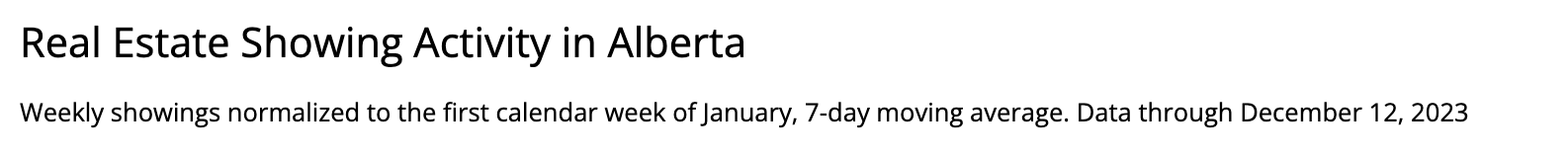

Here is a graph showing real estate showing activity in Alberta and you’ll note that the orange line clearly has activity pegged lower than the past 5 years. Our market is cyclical and as migration slows, more homes are built and more supply of homes give buyers more options, the past-surge of real estate sales is slowing, hence the 17% drop in Sales Volume in May 2025:

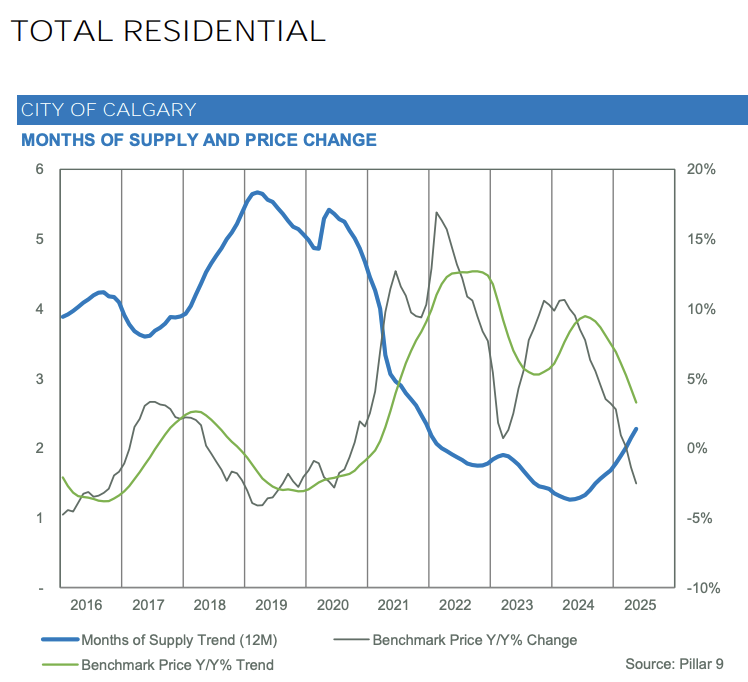

Below you’ll note that the blue line (supply of homes) is going upwards, while the green line (benchmark price) is going downwards. As these lines near each other it creates a Balanced Market like the one we are currently in. And if the lines intercept and continue in the same direction it inherently creates a Buyers Market. This data cannot be ignored and to me it highlights the true health of our real estate market.

Here is another one for good measure, Days on Market. As Days on Market lowers it means prices tend to rise which correlates with the rise in prices in 2020-2024. And now in 2025 that green line is beginning to go up again, which indicates that the market and prices are softening:

In summary, this new market is nothing to fear and as mentioned above I personally do not mind this market because the data to me is very clear. So if you’re looking to transact in real estate in 2025 it is imperative that you analyze where your specific community and home type sits within these statistics in order to make the most strategic decision for yourself and your family.

May was incredibly busy for our small team and June has continued with some long days and many happy clients. As always we are incredibly grateful for all of the continued support while we navigate this new real estate market in 2025!

I hope everyone has plans to enjoy the weather this weekend and that you’re planning to have an awesome summer 2025!

Cheers,

Justin

May 2025 Market Update

| Hi Friends, |

| Better late than never – Our spring market has officially arrived in May!

Our market the past few months has been quiet compared to recent years and to put it into perspective April Sales Volume was down 22% year over year. There is no denying a statistic like that when stating we are now in a new market. This really isn’t a surprise for a number of reasons:

And for these reasons the spring market was delayed as buyers and sellers wanted to see the dust settle a bit more before making a decision on how to transact in real estate. Now that we have clarity on some of the major influences on our market, the sales volume in the past few weeks has increased and we are certainly now in the typical spring market that we are used to. This does not mean that prices will skyrocket like in recent years, it just means that consumer confidence has increased enough to see some elevated sales volume that we typically expect to experience in March, April, May. As an example, last week two of my Calgary listings went into multiple offers which is less common in 2025 versus 2024. Other markets such as Airdrie or Cochrane are seeing more multiple-offer situations as the buyer pool increases, however, the level of home supply is increasing just as quickly, giving buyers more options and especially in the townhouse/ apartment segments. Here is a recent statement from the Calgary Real Estate Board that I found to be and accurate comment on our current market: “Economic uncertainty has weighed on home sales in our market, but levels are still outpacing activity reported during the challenging economic climate experienced prior to the pandemic,” said Ann-Marie Lurie, Chief Economist at CREB®. “This, in part, is related to our market’s situation before the recent shocks. Previous gains in migration, relatively stable employment levels, lower lending rates, and better supply choice compared to last year’s ultra-low levels have likely prevented a more significant pullback in sales and have kept home prices relatively stable.” said Ann-Marie Lurie, Chief Economist at the Calgary Real Estate Board. To summarize, we are not going to see prices significantly increase this spring for most home types and communities as we are very much in a balanced market now that spring is here. The golden rule in real estate is that you must price perfectly if you want above average results and with the current fast changing market this has never stood more true. I am seeing some home types in certain neighbourhoods correct to lower price points, however, I am also seeing some home types that still have ultra low supply in some communities go into multiple offer scenarios and sell above the benchmark pricing. As an example, a home in Killarney last week had 8 offers and sold $75,000 above list price! This is not common in the current market but some communities such as Killarney that still have ultra high demand are experiencing this at the moment. As always, we are incredibly grateful for the continued support as we navigate a changing real estate market. 2025 has certainly been a “curve ball” in terms of what we’ve become used to and now that the “new normal” is becoming clear, we are exposing some amazing opportunities within the marketplace for our buyers and sellers alike. To all of the mom’s, I hope that you had a wonderful Mother’s Day and that you were spoiled rotten! Have a wonderful May everyone and please ensure that you enjoy the fresh air and the beautiful outdoors that we are blessed with – We live in the best place on earth! Cheers, Justin |

April 2025 Market Update

| Hi Friends, |

It’s the CALM BEFORE THE STORM and we’re gearing up for either post-election real estate market turbulence with continued volatility or a post-election real estate market revival.

Regardless of the election result, I predict that we will see many sellers listing properties the first week of May once they have clarity on the future of Alberta/Canada and with this increased supply of properties hitting the market it will be interesting to watch if the buyer demand can match it to keep the market stable and balanced.

The caveat shaking up the market is that the builders continue to flood the market with more and more supply of new home options, specifically townhouses and multi-family projects.

Last month I noted that we have a new market upon us and on April 1st the Calgary Real Estate Board confirmed with data summarizing that March sales volume declined by 19% year over year.

Supply is going up! Where are the buyers?

Can demand match the supply or will prices come sliding down?

April has been an odd month in the real estate market as buyers continue to struggle with uncertainty and the external influences on our real estate market, mostly geo-political.

Additionally the financial markets have been volatile the past few weeks, which is concerning to some buyers on when the right time is to invest.

That being said, the buyers have not just disappeared, they’re still out there and depending on the election result, interest rates etc they could show up in masses by early May to surprise us.

April will continue with below average sales volume year over year and if we do not see demand match supply by mid-May then it will be safe to say that we are likely staring down a contractionary market. It will not be felt in all home types or market segments right away, and some sub-markets maybe not at all but it’ll certainly trickle throughout the market impacting pricing benchmarks.

I do not say this to create fear or concern, I am simply being realistic and it’s all data based supply and demand thoughts/decisions.

So to summarize, there is uncertainty in the market that causes volatility. With volatility comes opportunity and depending on which community you are transacting in, it may be a great time to list as a seller before navigating future markets or as a buyer, maybe this is the first time in a long time that you can get a healthy discount on a property!

The script has been flipped, the seller no longer holds all of the cards, it’s all about the buyer and making them happy right now! Specifically in the more affordable segments.

After last month’s newsletter I had some followers voice their concern to me that it was the first that they had heard of a new market and although it surprised them, they had appreciated the heads up so they could protect their real estate investments and plan accordingly. As the years go by we continue to be relationship and fact based first, versus a real estate team that always just says what people want to hear to make them feel comfortable. Successfully navigating markets is the result of doing transparent work, no matter what industry you’re in, give people pure honesty and that is what allows clients to win, in any market.

Over the past few weeks we’ve had sellers succeeding by listing with the perfect price. For the most part, buyers are not even considering properties that are overpriced, therefore the correct pricing continues to be the most important aspect for sellers to succeed and for buyers to transact.

This is achieved through our data based approach when determining an appropriate sale price and this approach is completely different from what we have deployed in recent spring market years where the market was expanding during a boom and we were trying to pinpoint where the market would land in 1-3 months (or by the next quarter) and transacting accordingly based on the possible future outlook.

We now have a balanced market, with many communities favouring the buyer so it’s quite the opposite where there is little to no growth expected, so we need to digest the data and appease the buyer. Again, with a new market comes new opportunities!

Here is a simple chart that displays “Real Estate Showing Activity” across Alberta and to me it’s a really great tool to gauge general consumer confidence in our cyclical market. Simply put, if buyers are out viewing homes then that means they’re confident in the market and want to transact in the market!

As you can see above, the 2025 weekly average ORANGE LINE is below recent years for activity, essentially once again confirming the true real estate market health that we are experiencing.

The federal election is 2 weeks away, we have another Bank of Canada interest rate announcement in 2 days and the supply of properties is growing amongst most of our market segments – it’s the calm before the storm!

The first few weeks of May are going to be wild with activity for our real estate market and this will give us clarity on what to expect for the next 2-3 months, I guarantee it!

As always, thanks to our followers, supporters, clients, friends and family for the incredible support – YOU ARE THE BEST!

Have an awesome April everyone and enjoy the calm before the storm.

Cheers,

Justin

March 2025 Market Update

| Hi Friends, |

Our real estate market has changed in 2025 and even though many media outlets and sources have not grasped the idea of a new market, the data cannot be denied. And as you all know, I trust in data and real numbers vs hunches when it comes to real estate advice so let’s dive into it below!

First off, there is no reason to panic for sellers or buyers, because a new market simply means understanding where the current opportunity exists and every different type of market can be fruitful if it’s navigated properly.

For sellers, this is not a market like 2021 to 2024 where expectations should be to sell way above list price (although it can still happen and we have had it happen already in 2025), or a market that buyers will be lined up at the front door begging to view. But that is okay!

It’s a market where the marketing matters more than ever to ensure that the highest number of buyers are stepping through the front door – buyers physically stepping foot in the door is what sells properties, not online views, social media or hits on a video. Those are all important tools and these tools should only be used if they’re supporting the ultimate goal which is to get buyers INSIDE the property, in my opinion.

The past few years the hottest segment of the market has been homes priced under $500,000 and this market segment still has strong sales volume, however, the largest increases we are seeing in the supply of homes right now is under $500,000. With more supply comes softer prices. Therefore, the longer this trend continues the more reasonable it is to suggest that prices have not only stabilized but could eventually begin to drop in our spring market.

The largest contributor to this shift in the under $500,000 segment has been the shear amount of new construction happening in our market. New apartment buildings, changes to zoning, townhouses everywhere (just look out the window next time you’re driving, it can’t be missed!) and as a whole this has levelled the market out giving buyers and renters an sufficient amount of options, that they no longer need to be paying above list price or settling for options that do not check every box because they now have a very powerful tool, the power of choice!

The take away here for sellers is that you need to truly understand the market and what is trending in your specific community or you’ll be caught in a position where everyone is successfully selling, except for you. Not only does price need to be perfect/reasonable but the strategic listing plan needs to encompass exactly where the market is today and where potential buyers are likely hoping/projecting the market will be in 30-60 days from now.

Luxury real estate & acreages might be the cream of the crop in 2025. Without diving too deep, simply put, there is a lack of luxury properties and acreages available in our market and with new construction focused on more affordable homes in recent years it has caused a shift in the market where we now have more demand for higher priced properties than available properties on the market. I will be keeping a close eye on this as the spring market kicks off this month!

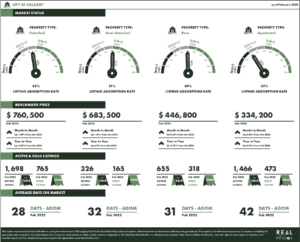

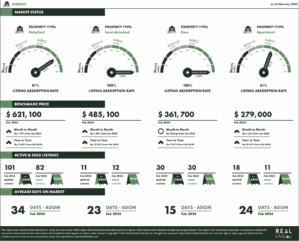

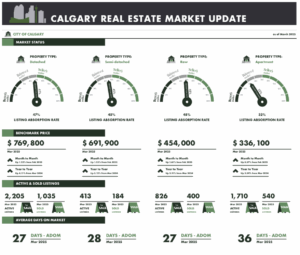

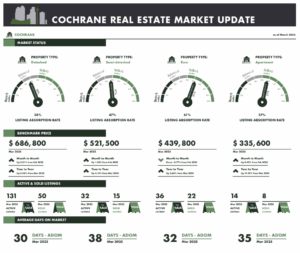

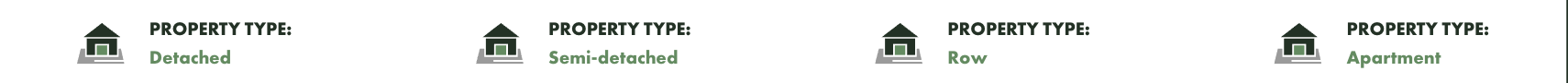

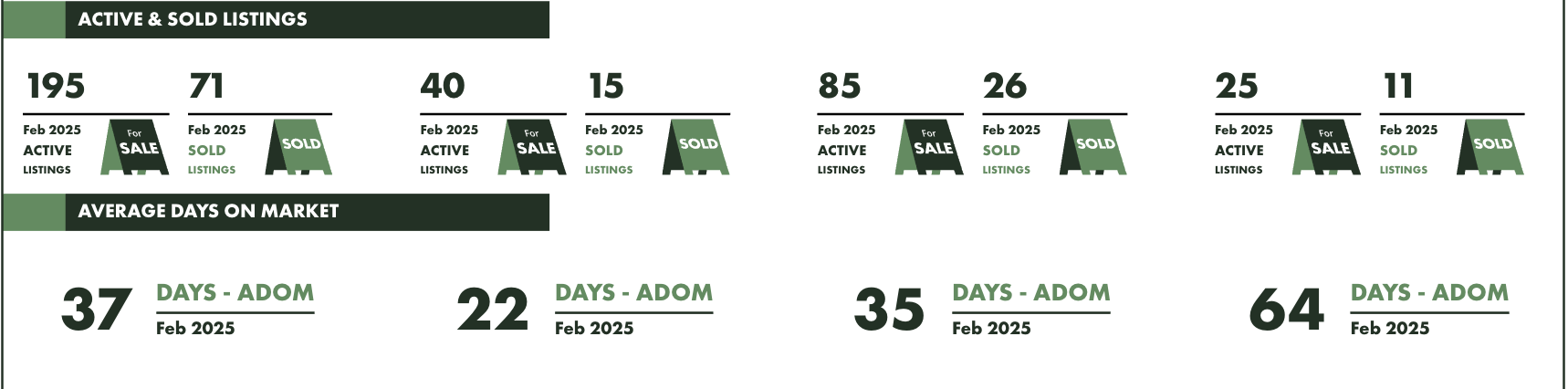

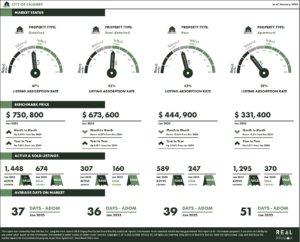

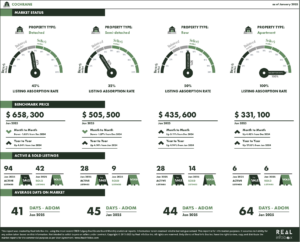

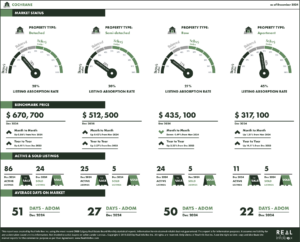

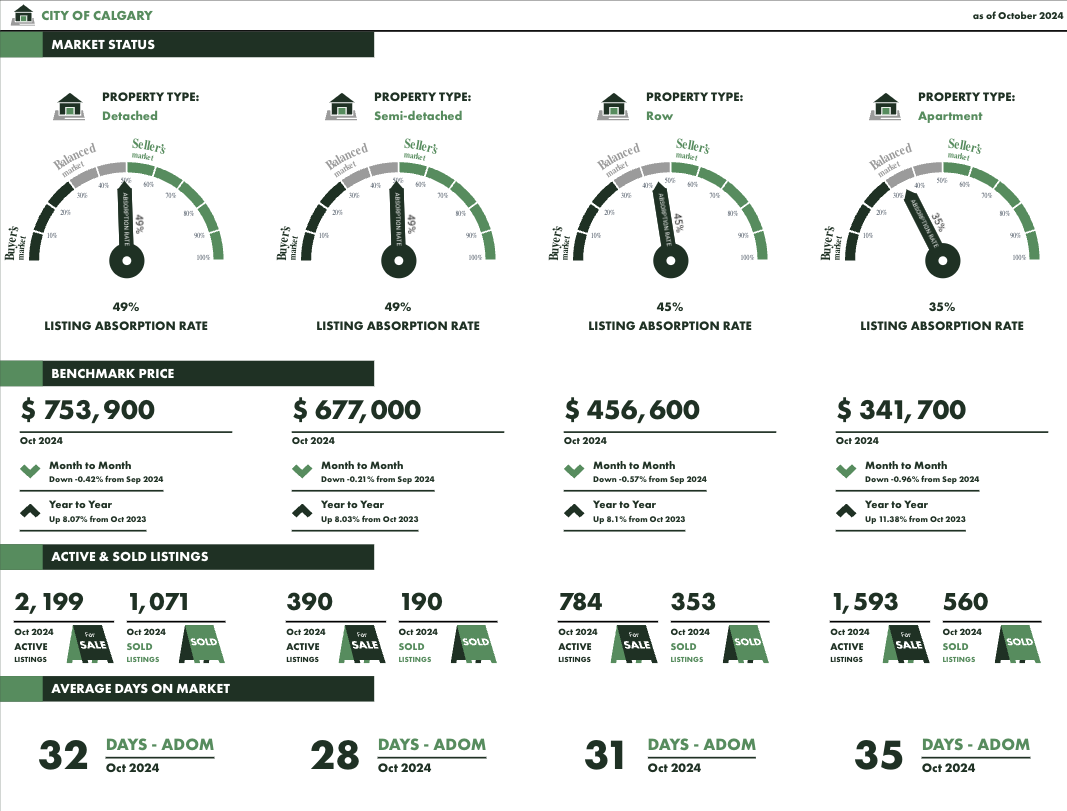

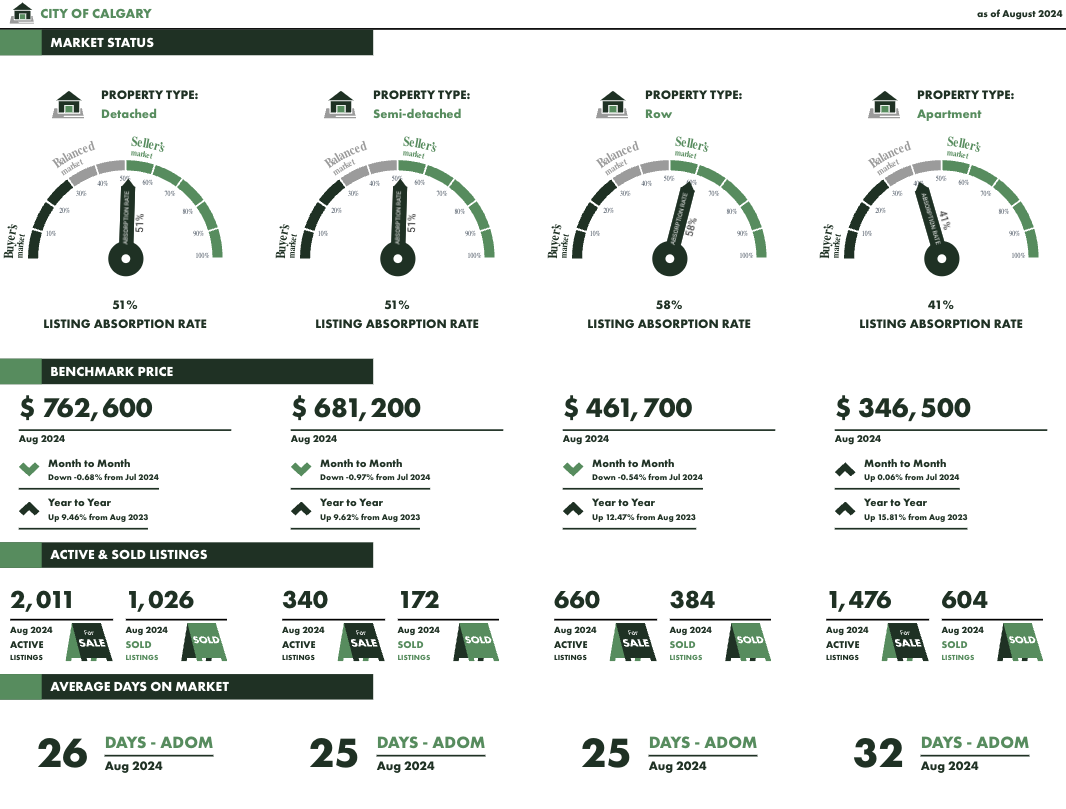

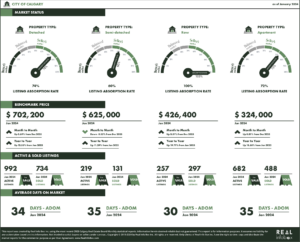

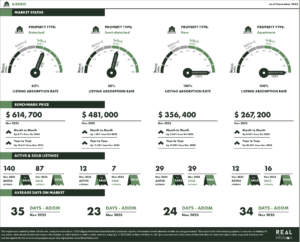

Here are some simple statistics to gauge the strength of some specific markets and property types in the past month.

I made some summary notes below each image and overall it appears the market is trending towards favouring the buyer in most segments:

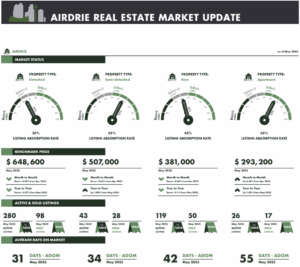

Calgary:

Summary:

Detached Homes: 45% of detached listings sold (no longer a sellers market/ market is trending towards favouring the buyer)

Semi-Detached: 51% of listings sold (no longer a sellers market, market is balanced)

Row Townhouses: 49% of Row Townhouses sold (no longer a sellers market, market is balanced)

Apartments: 32% of apartments sold (becoming a buyer’s market that favours the buyer vs the seller)

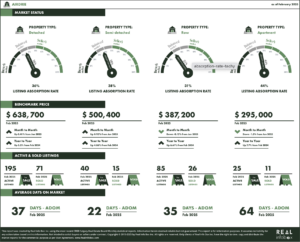

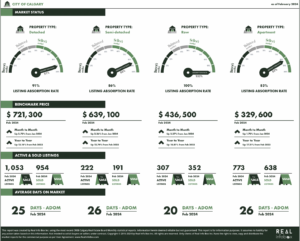

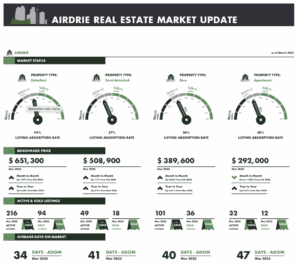

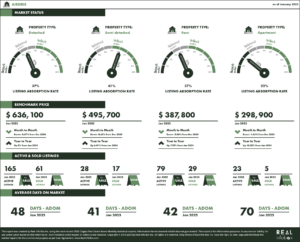

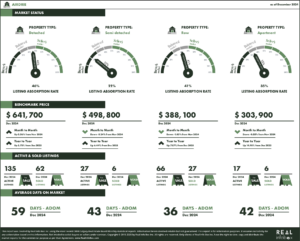

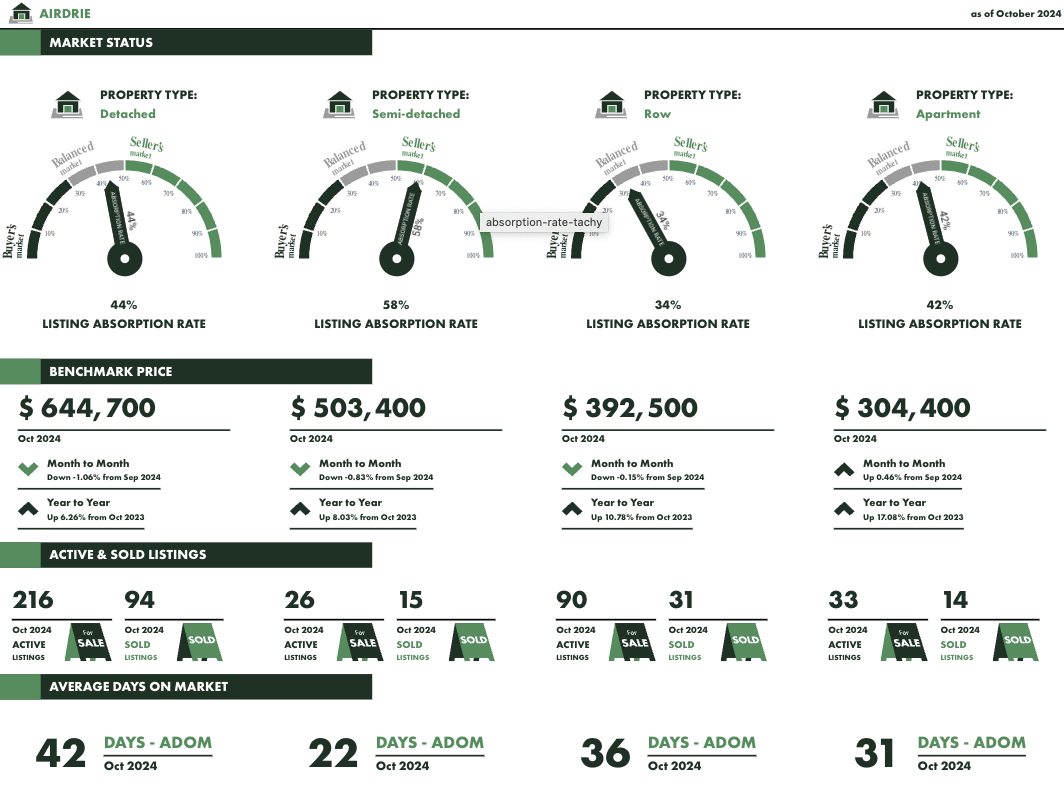

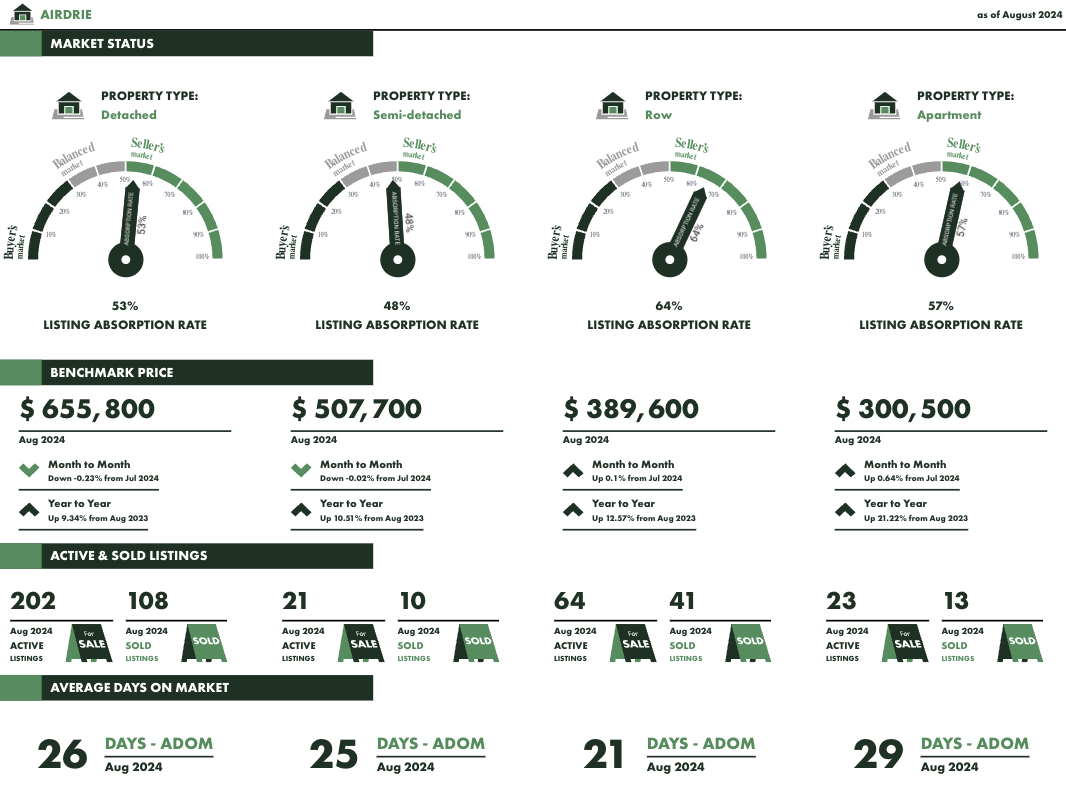

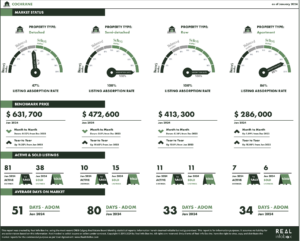

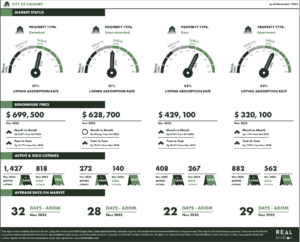

Airdrie:

Summary:

Detached Homes: 36% of detached listings sold (market is trending towards favouring the buyer)

Semi-Detached: 38% of listings sold (market is trending towards favouring the buyer)

Row Townhouses: 31% of Row Townhouses sold (no longer a balanced market, it’s becoming a buyer’s market)

Apartments: 44% of apartments sold (market is balanced but trending towards favouring the buyer)

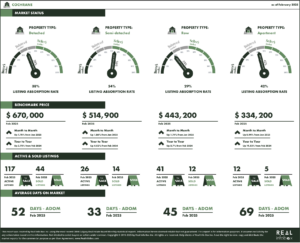

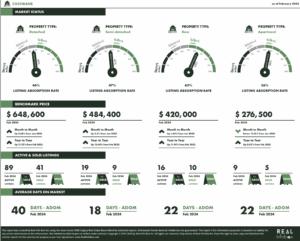

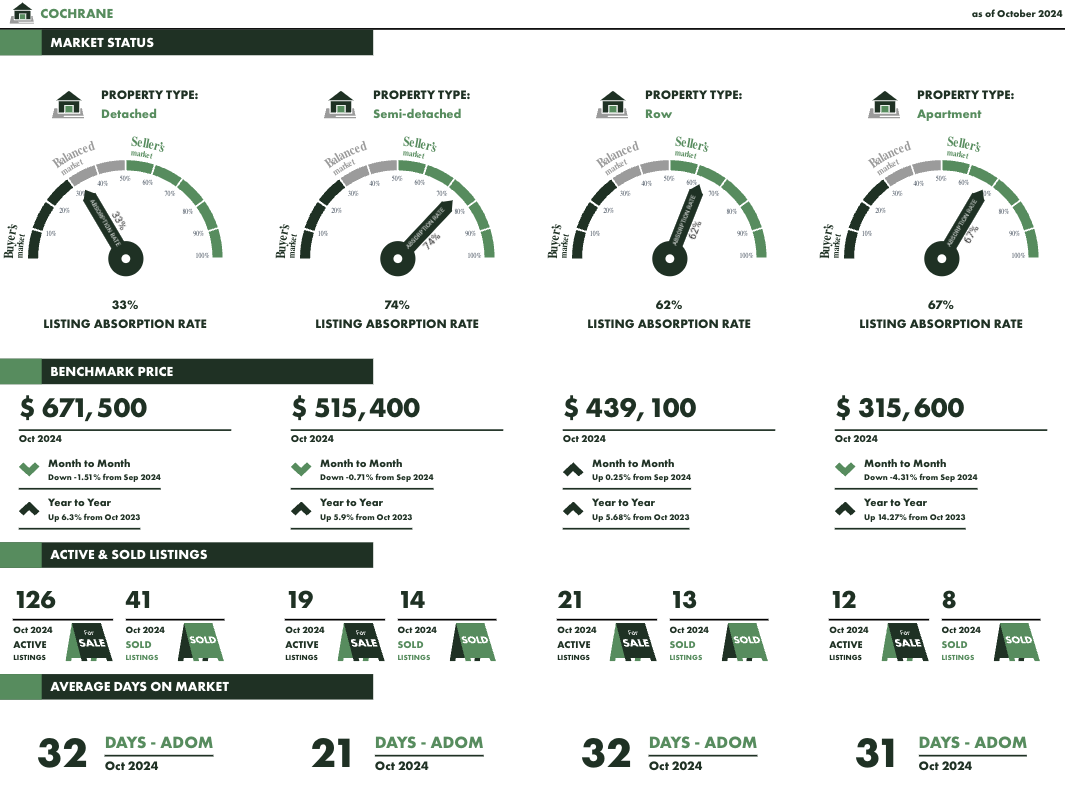

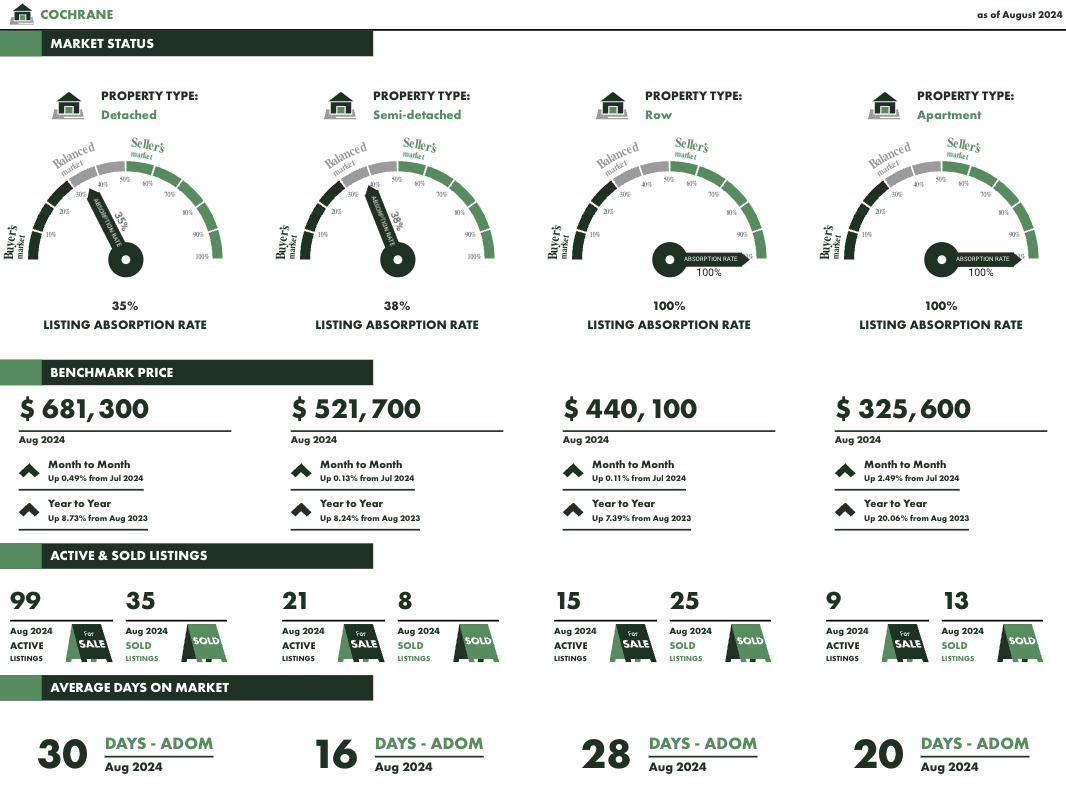

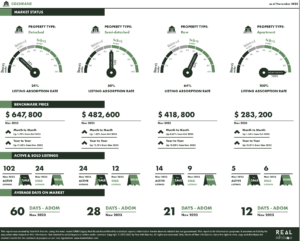

Cochrane:

Summary:

Detached Homes: 38% of detached listings sold (market is trending towards favouring the buyer)

Semi-Detached: 54% of listings sold (still a strong market favouring the seller)

Row Townhouses: 29% of Row Townhouses sold (buyer’s market)

Apartments: 42% of apartments sold (market is balanced but trending towards favouring the buyer)

In summary, we are no longer in a sellers market across most home types and communities and in fact we are heading the other direction in most. Many communities and sub-markets are already in a buyer’s market. That being said, I am still seeing many parts of our market that is in a sellers market, but only fragments here and there.

The market is fragmented, it’s different in every community and for every price point, therefore, this is why understanding this new market is so critical for success.

What we’ve grown to know about the market in the past few years is no longer relevant and we need to adapt and prepare for a new market. This is nothing to panic about, it just means that we need to be open to understanding what the true current market is and not just something that we’ve grown comfortable with over the past few years – which has essentially just been the expectation that prices are going up.

I personally think that we are at a crossroads at the moment with a lot of volatility happening that is impacting buyers/sellers ability to make a decision in our real estate market. I feel strongly that once/if some of these risks are mitigated that it will bring strength back into the market in the form of eager buyers to support further price growth.

Geopolitical Risk: Without going down a rabbit hole on this one, let’s just say it’s an absolute mess right now. Our neighbours to the south have new leadership and it’s having a large impact on our economy. AND we lack leadership here in Canada as we await a federal election and new leadership. Regardless of which Canadian party will get into power to lead us through 2025 and into 2026, they will need to find a solution to navigate the trade war we are in at the moment and those decisions may increase or decrease consumer confidence in the coming months.

In short, if consumers are not confident in the economy and the associated geopolitical risks, then they’re less likely to be investing or purchasing real estate – we need strong government leadership and swift action to instil confidence back into the economy.

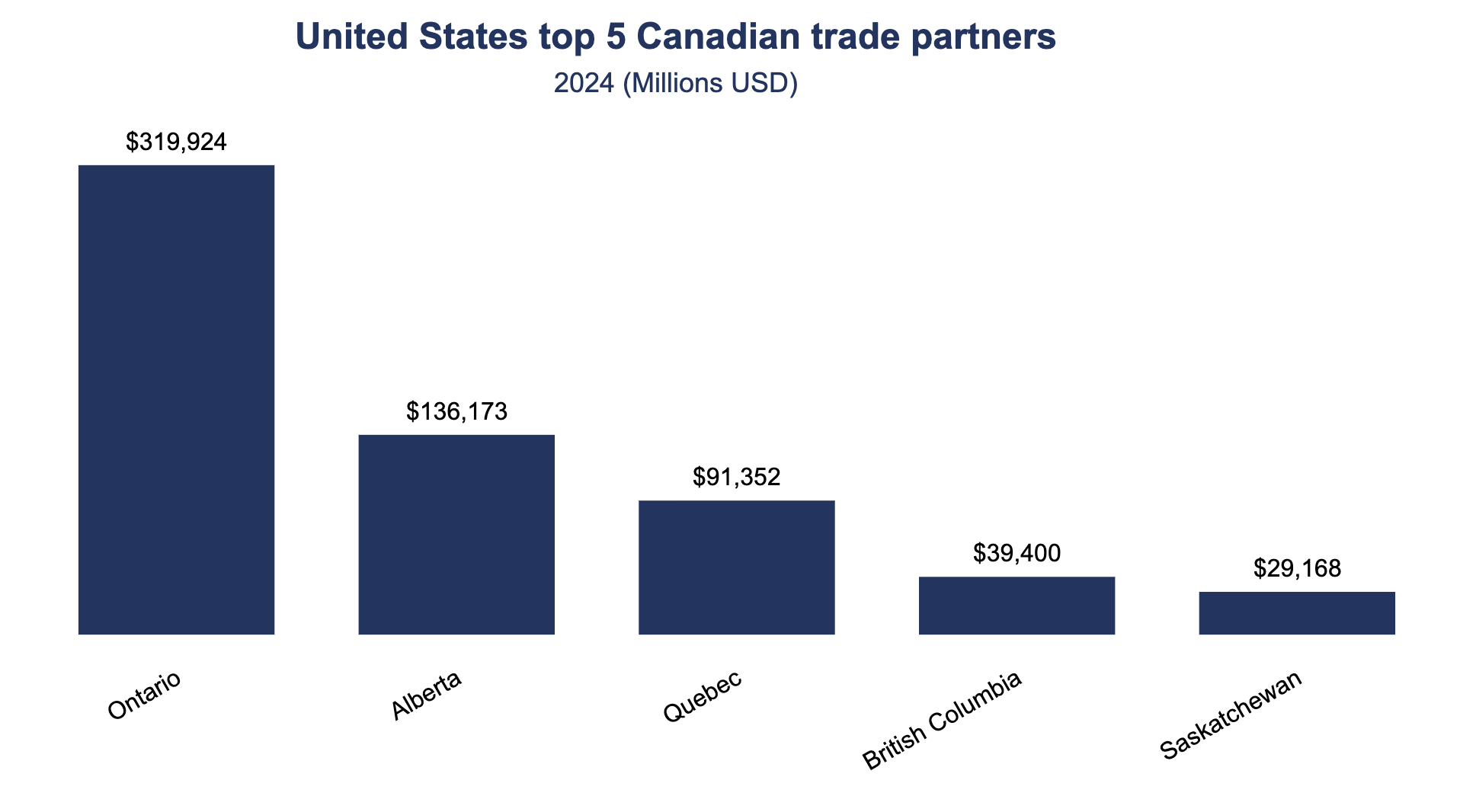

Tariffs: Below are some interesting statistics, but to keep it simple Alberta is a MAJOR trading partner with the U.S, one of the largest, and depending on what happens with the tariffs in the next few months, this will impact us as Albertans financially and again this will impact consumer confidence, which ultimately drives momentum in the real estate market.

Interest Rates: Although they’re likely to drop further, the real question I am asking is whether it’s enough to counteract all of the other market risks we are facing. AND even if interest rates drop in order to spark our economy/real estate market this comes with long term risks – I personally do not think dropping interest rates to save the economy is a healthy way to operate long term, it’s a short term band-aid solution.

That being said, the next interest rate announcement is coming soon on March 12th and depending on what the Bank of Canada announces it could be a little extra fuel on the fire to kick off the spring market and shift momentum.

Obviously there are many other risks but I would argue that these 3 topics above are the most top of mind in our market at the moment and there is absolutely no doubt that it is weighing and will continue to weigh on our real estate market.

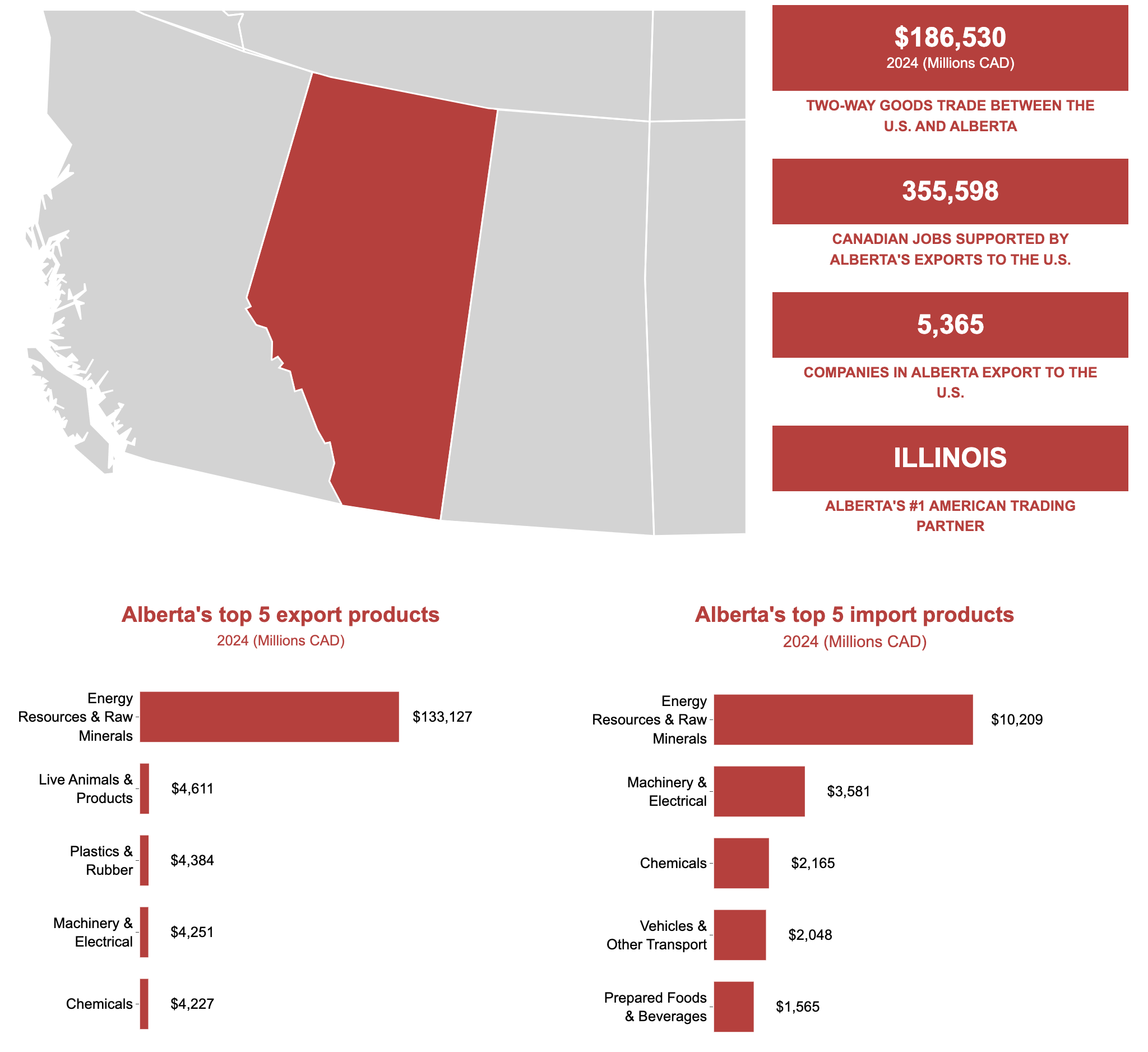

Alberta is a major trading partner with the U.S and this highlights why Alberta has a lot to lose (or gain) depending on how the tariffs are enforced in the coming months:

Source: Canadian Chamber of Commerce Business Data Lab

Specifically our largest industry, the energy sector:

Source: Canadian Chamber of Commerce Business Data Lab

Of course these tariffs will translate into cost/ economic impact for each person as projected below:

Source: Canadian Chamber of Commerce Business Data Lab

In summary, we are now in a new real estate market that is still fruitful and full of opportunity for both buyers and sellers. By providing the right guidance we are looking forward to helping hundreds of people in 2025 navigate this new market and as mentioned above, there is no reason to panic. There is only reason to be informed and to make informed decisions when transacting in real estate.

Thanks as always to our followers, clients, family and friends for continuing to make us the most fortunate real estate team in our market with your unwavering support.

We are beyond excited for the spring market and it’s going to be a busy one!

Cheers,

Justin

February 2025 Market Update

| Hi Friends, |

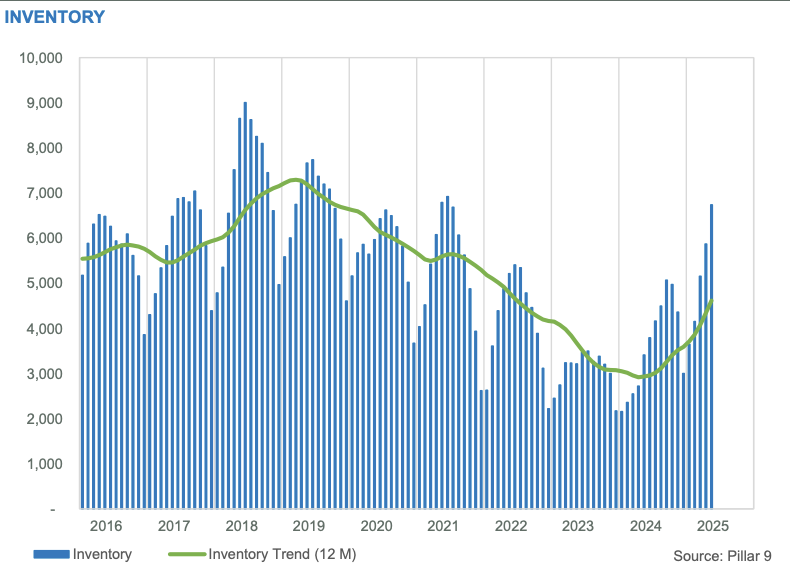

We are now one month into 2025 and the increased power of choice for buyers and projected higher supply of properties/inventory levels are going to dictate our market this year (as mentioned in last month’s newsletter). In January we experienced an increase in supply compared to recent historical levels and as we all know, it is simple economics that drives our local real estate market, the law of supply and demand always reigns supreme!

But there is more to it than just supply and demand, therefore let’s dig deeper to figure out what we can expect in 2025…. let’s go!

I think that we may see a shift from renting to owning because of the amount of more affordable homes, apartments specifically, being constructed. This compounded with lower interest rates and new flexible mortgage rules is opening the doors for many renters to get into the home ownership market. This will also in turn lower rental rates giving renters more choice within the rental market.

Additionally, our market has a staggering amount of rental purpose built properties being constructed which satisfies much of the rental demand, giving buyers with dreams of home ownership less competition as some renters may opt for these rental units instead.

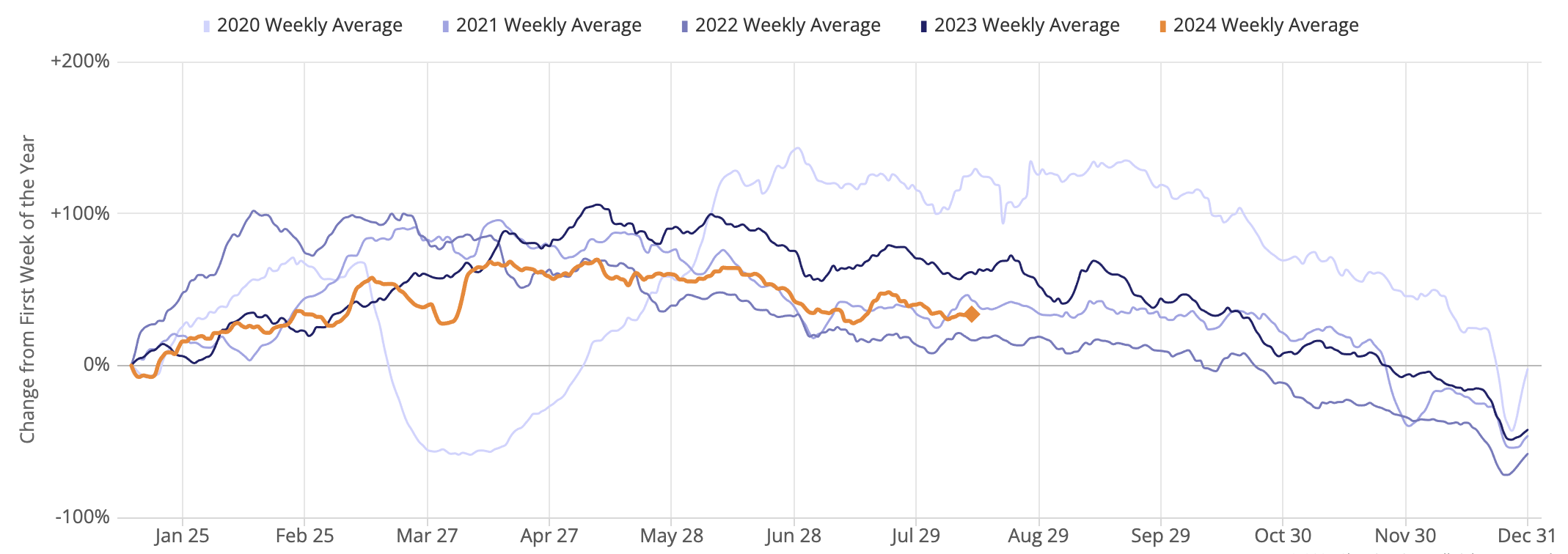

Statistics from Canada Mortgage and Housing Corporation (CMHC) for the first 10 months of 2024 show that attached and multiple family home construction starts were triple those of single-family.

In my opinion, if we look at history and for those of us who can reminisce on our 2014 market, there are some distinct similarities here that come with a boom/bust cycle when the market is flooded with new construction until eventually the supply outweighs the demand.

So have we officially added enough supply of homes to outweigh demand?

The answer is NO.

However, in the more affordable segments and especially for apartments it is likely that we will see the shift to a buyers market here first before the higher priced properties.

Interestingly, if we review the apartment market in Toronto they are seeing a mass influx of supply hit the market and according to recent CHMC reports they could see their highest supply levels in 5 years in 2025.

But how does this affect our market and why are we discussing what is happening in Toronto of all places?

Because if buyers see lower prices in other major markets they may decide to purchase in those markets versus migrating or remaining in our local market.

Also it’s a lesson that we can learn from in Calgary & Airdrie where we have apartment buildings being constructed city wide, (just go for a drive and you can’t miss them!) eventually the supply of apartments will outweigh buyer demand, inherently halting growth in pricing. The law of supply and demand wins again!

Luxury homes are continuing to lead the way and this is the result of the mass amount of new Alberta residents that have arrived in the past 4 years.

With this mass migration we have had a large percentage of new residents who joined us from higher priced markets and they can afford the higher priced homes that our market offers, inherently driving up prices and keeping demand strong. I expect that we will continue to see a high level of demand for luxury properties in 2025, so it’s good news for those folks!

For example, if you’ve had dreams of buying an acreage, the prices have risen astronomically and to no surprise many of the buyers who’ve taken advantage of purchasing these properties have been from out of province.

There are many factors that contribute to the health of our local real estate market and I truly believe that geopolitical influences will be a major influence in 2025.

In short, THE MARKET IS VOLATILE due to geopolitical influences!

And what I mean by this is that we have major geopolitical influences within and also outside of Canada that can change consumer confidence in our market and consumer confidence is a metric that is very tough to measure as it’s never constant. If buyers are unsure of the health or future of our economy then they’re less likely to invest in our real estate market, in my opinion.

For the benchmark priced properties and specifically your average single family detached property it is truly a balanced market. This means that when selling your property the pricing needs to be perfect, there is no room for error on this. With enough options for buyers you MUST price accordingly and you MUST have a strategic marketing plan in place to shine above all the competition.

Simply putting your property on the market without a strategic plan is no different than a goal without a plan – a goal without a plan is just a wish!

In summary, the supply of properties on the market is slowly rising, luxury properties are still in high demand, homes need to be priced right in order to achieve top dollar and the big caveat to watch out for is Geopolitical Influence that can change the health of the real estate market very quickly.

Our Realty Aces team has been heating up in 2025 as the market begins to take shape and we are incredibly grateful for the continued support from our clients, followers, friends and family – you are our fuel and we appreciate you so much!

Have a wonderful February everyone and stay warm!

Cheers,

Justin

Your Local.Realty.Aces at Grassroots Realty Group

January 2025 Market Update

| Hi Friends, |

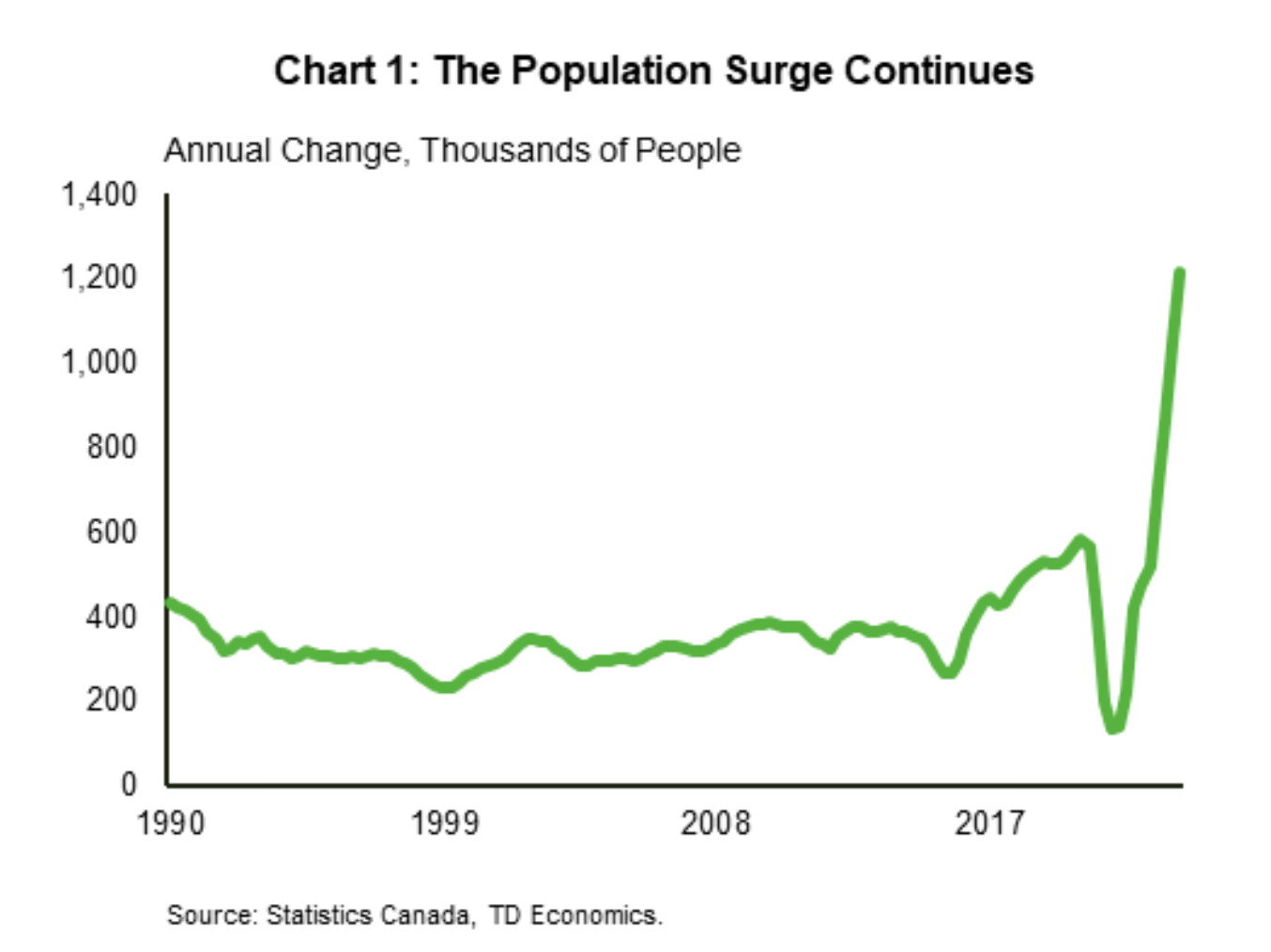

It’s no secret that our local real estate market has all eyes focused on it across Canada with the mass migration that we have recently experienced and if you have driven to any outskirts of Calgary, Airdrie or Cochrane recently then you’ll see a shocking amount of new home construction taking place.

Simply put, we are still in the midst of a population boom and when the dust settles our community is going to look very different. With growth comes pain as well, so we can’t be naive and think that everything is great (just to even consider the lack of infrastructure and lack of schools as an example), we are still on a rollercoaster, so buckle up and let’s dive into it!

And yes, we will talk politics – because it’s just unavoidable at the moment!

Let’s begin with discussing the supply of homes in the market for buyers to choose from as this will be our most important metric to follow in 2025. As you’ll note in the statistics posted below, we’ve had a healthier supply of properties enter the market since Q4 2024 and this is relieving some pressure for buyers. If we can continue to have enough choice in the marketplace, then we can expect a more stable year in 2025 without exponential growth in home prices. New construction is the savour for supply in our market right now, which is providing buyers more options.

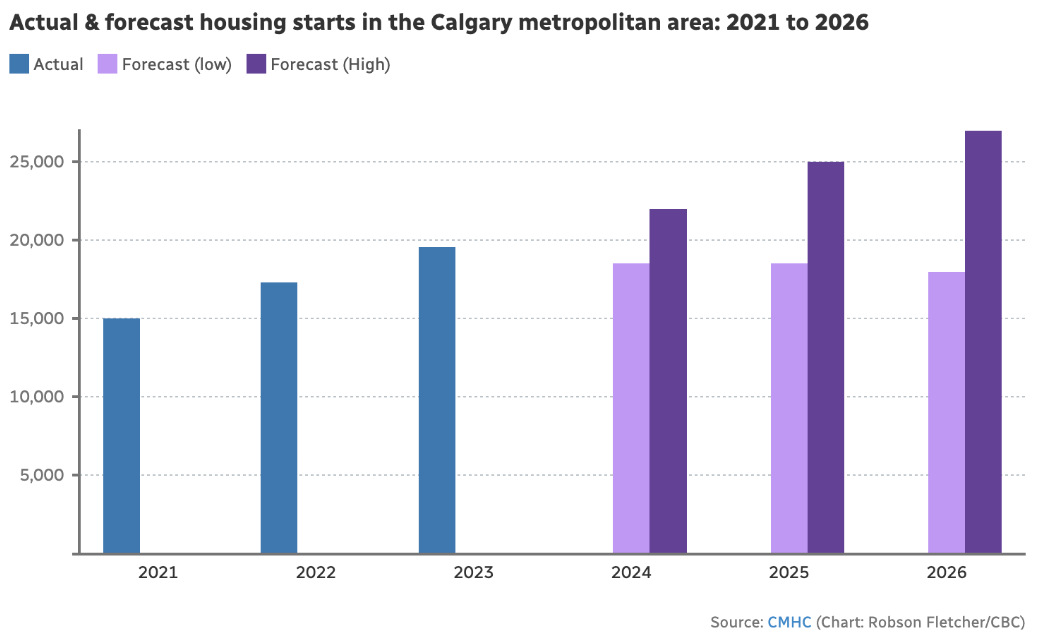

Net migration to Alberta and our market specifically will be the main determinant of whether we can keep the supply balanced or not. Let’s call a spade a spade here, Canada’s immigration policy is broken, and we do not have enough homes -we are still in a Canada wide housing crisis! The demand has been unbalanced the past few years and this is not a problem that we will solve overnight. We need more homes and believe it or not, Alberta is still more affordable than most other major markets in Canada.

It seems wild when I sit down and reflect on our market growth over the past 5 years and that it’s not yet went through a bust, however, the simple economics here of supply and demand are still in control. Net migration will continue to be evaluated in 2025 and it remains to be seen whether or not the amount of new construction will fill the void of demand or not.

Ok fine, let’s talk politics……

In previous newsletters you may have noted that I like to stay apolitical and please know that I respect every individual has a right to their own personal beliefs and values. And I will continue to do that and focus on how I believe politics and geopolitical influences will shape our real estate market specifically in 2025.

Let’s begin with the elephant in the room, Trump.

There is much speculation on what Trump is going to do with tariffs on Canada and more specifically our Oil & Gas sector in Alberta. There are pros and cons to how a new relationship with Trump may be formed. The one thing I am certain of is that he is someone who will do what is best for his country before he favours Canada and no disrespect to Trump, it just means that we better be ready to negotiate and get what us sovereign Canadians deserve.

So to summarize the Trump geopolitical influence in 2025, he’s not even president yet and the speculation is ballooning, so I will not say with certainty what is going to happen, however, I do know that this is going to hit our real estate market like a ton of bricks when it does if we aren’t ready to negotiate.

Next let’s talk about Trudeau….

We all know he’ll be gone soon and whether you’re a supporter or not it’s just a fact that a change is coming. From what I have read and from what my instincts tell me, is that an alarming majority of Canadians want to see a change in leadership and assuming the projections/statistics are all correct and this change comes in mid 2025, then this is a positive thing for our market. I look at this from a holistic view where if ‘most Canadians’ want to see a change AND then when they get the wanted change, consumer confidence will rise. This should in theory make Canadians more comfortable to invest in their own country and local real estate markets if they feel more comfortable with their government.

Also, foreign investment into Canada and Alberta will see a major shift in 2025 as we likely see a change in government leaders. I will project right now that this could be one of the main topics of discussion later this year or in 2026.

Obviously we could break down the geopolitical influences within Canada even further but I will leave it up to each of you individually to make your own decisions, just as you are entitled to. As a proud Canadian myself I am deeply bothered by the state of our country right now, the divide, the poor GDP per capita rate compared to the other G7 countries, our tanking CAD dollar etc etc etc….. and we need to figure it out quickly because Trump down south will not be taking his sweet time to make moves. Time to wake up Canada, let’s go!

Overall, this year is going to be a real estate market like no other that we have experienced recently and largely because there are some major geopolitical influences and market drivers such as migration, control of supply etc that have not completely shown their cards yet.

As we enter the spring market I do believe that the trajectory will be more clear. We are certainly not projected to see home prices drop, we are currently in a balanced market across most communities (as you can see below) and as mentioned above the management of the supply of homes will dictate the amount of growth our market experiences this spring.

2024 was a year that our small team levelled up and took a big step forward!

It was the year we created our trio which proved to be a recipe for success with Justin, Ryan & Damien selling an extremely high volume of real estate. The new team came with excitement & its share of challenges but it was all 100% worth it as we were able to be a part of 132 real estate transactions in 2024! We are proud of the hard work we put forth all year long & beyond grateful to say the least.

This would not be possible without you- our friends, families, clients & supporters. THANK YOU for choosing us, for your referrals, Google reviews, and for your unwavering support. We cannot wait to break records again in 2025! And from all of us on the Realty Aces Team at Grassroots Realty Group, HAPPY NEW YEAR and let’s go make 2025 an awesome year!

Cheers,

Justin

November 2024 Market Update

| Hi Friends, |

| It may seem odd that we are saying that it’s a wrap on our local real estate market with 1.5 months still remaining in the year, however, the reality is that we are unlikely to see any major market shifts for the remainder of this year and buyer activity will be seasonally lower until the new year.

So with the data readily available right now why wait? Let’s review what happened in 2024! Similar to recent years we came out of the gates hot as a pistol and many sellers/buyers alike capitalized on the market early on in the year, with peak market activity and pricing coming in May. Many sellers across our market this fall have been grasping on to spring prices and they’re just not going to sell because everything is selling at a more competitive price point if you want to sell this late in the calendar year with a larger level on inventory. May to August our market was stable with strong activity and the fall has been a quieter market. Fortunately, as a team we have remained extremely busy this fall but the market in general took a turn. This doesn’t mean that the market crashed, it just means that the fall market has been a quieter than usual in terms of buyer activity and it’s truly not surprising because Jan to May in 2024 was extremely heavy for activity. So let’s call it a “tale of two halves”. Does this mean that our market in 2025 is poised to go crazy again if current seasonal trends continue? Let’s dig into this….. Overall 2024 has been an incredible year for our market in terms of an increasing benchmark home price. To put it in perspective check this out below, with a focus on DETACHED properties in Calgary, Airdrie and Cochrane as an example: We don’t have a crystal ball and there are so many changing factors throughout the year, however, with that being said, we are proud to say that we did predict in early 2024 via this newsletter that we would experience between 8-10% in growth across our markets, so with proper deep analysis (and maybe a bit of luck) to make our predictions come true, we are proud to say that we nailed it back in early 2024. Below is some seasonal data to support why we can say with confidence that our market will be slower from now until the new year: *note the decline seasonally mid-late Nov and incline in Jan/Feb. This lull is short term!   Sorry to say it, but once that snow flies and we all move into “holiday season mode”, real estate will slow as it always does. But it’s only temporary! So what is going to happen in 2025? Rewind 12 months ago to Mid-Nov 2023 and we knew 2024 was going to be another growth year, the data and statistics made this very clear. But it’s different this time around because our market has moved from a Sellers Market into a Balanced Market, with some of our sub-markets sliding into a Buyers Market. And essentially the data is not pointing to another major growth market at this point in time as it was 12-months ago. But this is interesting…. With interest rates on the decline Buyers are already betting on 2025 and are hopeful for lower rates. Especially with another highly expected rate drop coming next month! This may be the drop that ignites the market for January…… Sellers are ALSO betting on 2025 nationwide, check out this excerpt that sums up a recent article in RealEstateMagazine.ca: “Nationwide, an average of 23.6 percent of house listings are being cancelled, compared to the usual average of 15.1 per cent.” This time of year it’s expected that we see listings cancelled as the snow flies and buyer demand slows until the new year, but it’s happening nationwide and if we read between the lines then maybe, just maybe, this tells us that Buyers are waiting for more financial flexibility via better rates before purchasing and Sellers are betting on 2025 versus holding on to 2024 prices/ a slowing market. Of course I could be wrong as this is an assumption but even on the front lines right now our team is speaking with our upcoming sellers and nearly all of them are waiting until the new year to list. If this data and theory behind increased cancelled listings holds true, compounded with lower interest rates and a continued housing shortage, then I would argue that our spring market will bring more growth. As of now I do not foresee the same level of growth as we experienced in 2024 (8-10% +/-), but I do think it’s feasible to see some modest growth if enough Buyers activate into the market in early 2025. It’s too early to say exactly what our spring 2025 market will look like and by January we should be able to accurately pinpoint where the market will land in 2025. Sorry that it’s not a perfect answer but it’s the truth and as time passes over the next 30-45 days we will have some solid predictions. So stay tuned! You folks have made 2024 another amazing year for us, so THANK YOU for continuing to support us. The Realty Aces as a three amigos squad set a goal at the beginning of 2024 to sell 125 properties and we have been fortunate to have already surpassed our goal which is pretty darn cool. The only reason we have found success is because our clients, friends and family have continued to advocate for us, support us, appreciate our process and help fuel our referral based business. Even with the next 1.5 months being a slower market our team is still working our butts off everyday to become better and stay at the top. It’s always a grind, so call us crazy but we just love the challenge so it will be fun to set the bar higher in 2025 and be even better at what we do. Again, thank you all for continuing along on this journey with us. As always, we are here to help with any real estate questions, so hit us up as we are real estate nerds who love to chat real estate anytime. Enjoy the rest of your 2024, the upcoming holiday season and all the best to you and your family in 2025! Cheers, Justin |

|

|

|

|

|

|

|

| The guys will be participating in Movember this year to raise money for men’s health- Mental health & suicide prevention, prostate cancer & testicular cancer.

“Our fathers, partners, brothers and friends are facing a health crisis, yet it’s rarely talked about. Men are dying too young. We can’t afford to stay silent.” Donate here: https://ca.movember.com/donate/details?teamId=2480245#amount |

October 2024 Market Update

| Hi Friends, |

As mentioned last month, the market has shifted and newly released data from the real estate board supports the prediction. Simply put, the supply of properties is rising while buyer demand is declining. As you’ll see below with the infographics, many property types amongst our local markets have shifted into Balanced Market territory and we are no longer a heavy Sellers Market. Some price points for certain property types in specific communities have even shifted into a Buyers Market in the past few weeks!

This is great news for Buyers! For Sellers it just means we need to have a strategic plan in place that fits the current market and we must understand that a strategy that worked to sell a home in May/June needs to be tailored to a new strategy for October because this is a very different market.

Although the market has cooled, let’s remember that our market is seasonal and this balanced market may only be short term. As mentioned back in the June newsletter, we hit peak market in May/June and the market was unlikely to see further growth July forward in the second half of the year since our sales volume was so high in the first half.

Officially in the 4th quarter of the year now I stand by that statement, we will not see further growth in 2024, we may even see some better pricing in some of the sub markets that have been flooded with housing inventory in Sept – but they won’t be major adjustments, that would take much more time in my opinion. The market always goes up faster than it comes down.

In the past month there have been some recent changes in the housing market for homebuyers. These changes are intended to increase accessibility to properties for buyers and some flexibility for current homeowners and they’re important for you to understand how they may impact you!

Changes Starting Dec 15th, 2025:

Expanded Amortizations For First-Time Homebuyers

1. New Lower Income Requirement–> By extending the amortization period to 30 years, the income required to qualify for a home purchase decreases.

2. Reduced Monthly Payments–> For example, on a $600,000 purchase, the monthly payment could drop by approximately $250.

Increased Insured Mortgage Cap to $1.5 million

This allows buyers to accelerate their path to owning a larger property with the option now to put down a smaller down deposit. Previously, purchasing a $1.4 million home required a down payment of $280,000. Now, as of December, clients can potentially purchase the same property with a down payment of about $115,000 — a savings of $165,000.00 in upfront requirements.

Switching Lenders at Mortgage Renewal

The Canadian Mortgage Charter now allows insured mortgage holders to switch lenders at renewal without undergoing a stress test. This allows buyers the opportunity to shop around for better mortgage instruments and more competitive rates at renewal vs being pigeon holed into using the same lender for another term.

Lastly, two Tax Savings Strategies Were Added

1. RRSP Withdrawal Limit Increase–>The RRSP withdrawal limit has increased from $35,000 to $60,000.

2. The First Time Home Buyer Account Account-> This tool allows clients to save $8,000 per year in contribution room, which reduces your taxable income.

The truth is that the federal government and the governing bodies who control our real estate market here in Alberta are focused on the larger Canadian markets and these changes are now in place to benefit us sure, but they were created because they’re trying to increase affordability and home ownership in inflated markets such as Toronto or Vancouver.

Couple these changes with interest rates on the decline and we may be positioned for a strong market in early 2025. The effects of these changes and forthcoming lower rates will take time, but as we all know once the buyer frenzy begins, it happens very quickly!

So if you’re a buyer in the last quarter of 2024, you may find some great deals out there as the market is now balanced for most property types and properties are no longer selling as quickly as the first half of 2024.

For Sellers, we’ve hit peak pricing and there is no guarantee that the housing inventory declines enough in 2025 to see another growth year. However, many economists are predicting another strong year with modest growth. I do not have a crystal ball so I rely on facts/data and for now we know that we won’t see growth in terms of pricing in the next 3 months and what happens in 2025 is to be determined. Especially because many of the new changes come into effect Dec 15th so its too early to judge the impact of these changes.

As we roll into fall, we would like to reflect back on the summer. It was a great one for us and we were able to help a ton of people with their real estate goals. Thank you friends, family & clients! Your loyalty fuels our passion. Thank you for choosing us again & again, this referral based business is what we always hoped it would be!

October looks to be treating us with some awesome weather, woo hoo!

As always, please reach out anytime with your real estate questions.

Cheers,

Justin

September 2024 Market Update

| Hi Friends, |

| Last month my newsletter was titled “The Tale of Two Halves”, where I essentially laid out my thoughts on how the market was shifting and will continue shifting towards a balanced market. Not all specific markets or communities have shifted away from a Seller’s Market into a Balanced Market, but many have despite what the mainstream media is telling you!

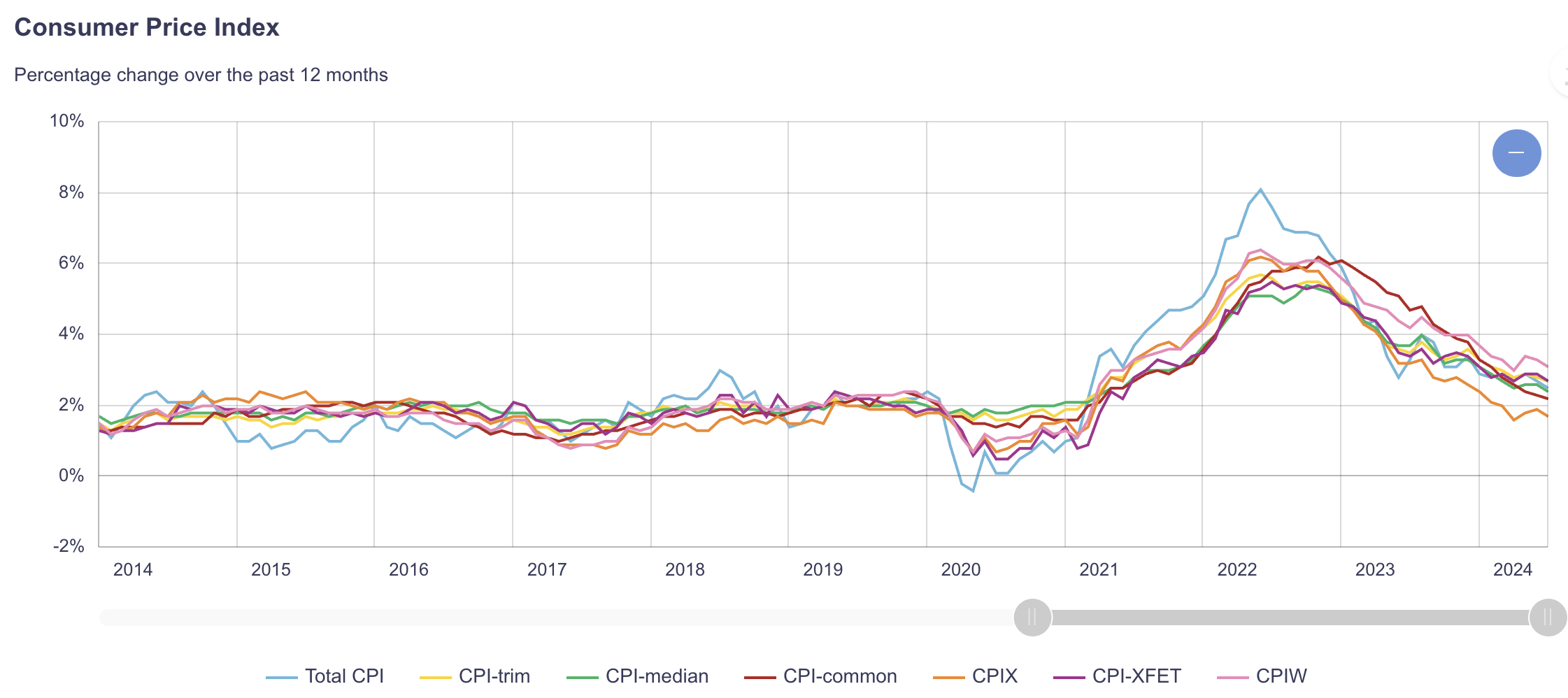

The Calgary Real Estate Board (CREB) released a statement on Sept 3rd confirming what my thoughts were last month by saying “Housing activity continues to move away from the extreme sellers’ market conditions experienced through the spring.” The CREB Chief Economist also noted that “it will take time” to achieve balanced conditions, however, they review and publish reports on the data once a month and I would argue that as a real estate professional that is out working in the field, I can see these shifts or market changes quicker because I am reviewing the data daily and working with clients daily as we decipher the trends and where the working is heading. And with that being said, I will tell you right now that I believe that we’ve shifted into balanced conditions for many price points and communities. I suspect that in early October when CREB releases their next report that you see it all over mainstream media about how we’re now in a more balanced market. Listings are no longer all selling first weekend on market (but many are!) and sellers MUST price their listings perfectly to attract a solid buyer. This does not mean that our market is experiencing a “downturn” nor are home prices falling at the moment. Let’s be clear about that! Our current market is just as it sounds, balanced, meaning there is equal opportunity for Sellers & Buyers. It no longer extremely favours the Sellers, in most communities and at most price points. As mentioned previously, peak market for price gains was in May/June and the new price points for each home type and market was set then. We are now hovering at this price point and it’s unlikely that it’ll decline much if any at all this year. So now that we’ve established what our market will look like for the remainder of 2024…. what does our real estate market look like in 2025? It’s not as clear as it has been in previous years and mostly because we have a more balanced fall market upon us than previous years and if housing inventory climbs too high then the potential home price gains that many expect in the spring of 2025 will be difficult to achieve. Here is a list of the market drivers that I believe will impact our local market the most in 2025: 1. Migration: This is a main economic driver that has influenced our market to boom in the past 4 years. However, the many buyers migrating to Alberta from Ontario and BC are now coming in slower waves it seems. The fact that these other markets are experiencing a “bust”, this is enticing buyers to capitalize on lower pricing in those other markets and prices that those markets have not experienced in years. 2. Political Influences: A Canadian Federal Election would shake things up and depending on which party succeeds it could inject a jolt of confidence into our market. I will leave it there as it doesn’t matter to me what colour of politics you bleed, I am just here to state the fact that an election and its associated results will largely impact our market in 2025. Also you’re likely well aware of the ongoing U.S election and this will also impact our economy depending on the results, and specifically our Energy sector that is directly tied to the U.S. 3. Energy Sector: Although we have diversified our local economy away from energy we are still heavily tied to the success of the energy sector. The energy sector will be influenced largely by politics/ foreign investment and depending on who is in power it will influence the success of this sector in 2025 which employs so many of us Albertans. 4. Interest Rates: With the Bank of Canada delivering their 3rd interest rate drop last week since June, it is obvious to see that they’re trying to ensure our economy doesn’t crash. I spoke about this in previous newsletters, how small businesses and corporations will suffer from higher interest rates and this will create job loss and many businesses will fail. Now that the geniuses at the Bank of Canada have curbed inflation by too quickly raising interest rates, they are dropping them just as fast as they do damage control. This is going to inject more buyers into our market as lending continues to become more affordable! Also it will have many buyers on the sideline this fall as many believe the rates will continue to drop and they’re waiting to capitalize in early 2025. AND hoping that prices do not increase by the time they enter the market, this is real risk as they attempt to time the market. 5. Supply, Demand & New Builds: I am watching closely to see if builders are still selling new builds as quickly as they have the past few years, and they are not. They’re still selling at above average levels, however, the pace of sales has slightly slowed down. I believe that this is largely due to the slow down of migration from other provinces as mentioned above, as these out of province folks have been targeting new builds the past few years so as they decline so will new the pace of sales. 6. Consumer Price Index: You may have noticed that some goods have become more affordable compared to say 12 months ago, such as vehicles as an example. And note I am not saying life is affordable right now because the price of most goods is criminal in my opinion. The raise in interest rates and the battle against inflation now has the price index decreasing. People and businesses have been bleeding financially and if the price index drops enough we may see more liquidity for consumers. Alternatively,, we have begin to see more reasonable rental rates for properties, inherently making the rental market more enticing for some buyers.  I believe that these economic drivers above will shape our market in 2025 and have the largest impact, in conjunction with many other smaller drivers of course. The past month has been a busy one for your Local. Realty. Aces! We were fortunate to sell over $10 Million in real estate and the market is certainly not slow at the moment as we continue to lead the market and achieve above average results for our clients. Even though the market is more balanced, we are busier than ever and it will certainly be a busy fall market. The only reason we are able to achieve the results we do is because we have the best clients who continue to trust in us, refer us to their friends/family, and work alongside us as we navigate the real estate market day in and day out. Thank you, thank you, thank you! It looks like we are in for a decent Sept weather wise, so get outside and enjoy some sunshine and fresh air! Cheers, Justin |

|

|

|

|

|

|

August 2024 Market Update

| Hi Friends, |

| Stability is the name of the game and this shouldn’t come as a surprise because this has been alluded to in the past two monthly newsletters on how we’ve hit peak pricing for the year and how the market is now entering/ has now entered a state of stabilization with more stable prices.

Here is a quote from the Calgary Real Estate Board Chief Economist on Aug 1st, 2024 “Should inventories continue to rise, we should start to see more balanced conditions and stability in home prices”. The writing is on the wall that we are entering a more stable market and that inventories should continue to rise in 2024. It is rather apparent that we’ve experienced the gains we will see for most home types in 2024 and we should continue to see inventory rise as we enter the fall and Q4. Days on market will continue to rise and more listings will fail, especially if they’re overpriced, even by the slightest margin. Pricing a property perfectly is hands down the most important item any seller needs to consider in this current market. $5-10K over market value, even though this may seem minor to some, could be the difference of taking an extra month to sell or to even sell at all. A few months ago we hit peak pricing and we discussed this and so it’s no surprise that we need to price properties at the peak, not over the peak and not under the peak because Buyers now have options on the market and they know if a price is acceptable or not! I’ve had sellers calling me and asking if now is the time to sell their property while we are at the top of the market and honestly it is case by case on whether it makes sense to sell now or wait until 2025. There is risk with waiting for the next spring market if prices begin to decline or if we have too much inventory entering the market, both new and resale. I do not think that 2025 will be an exponential growth year for our market and it all hinges on migration – to no surprise. As long as we have more people to put in homes then the market will continue to grow. That being said, let’s not be naive and begin to think the market will not plateau and eventually bust, because it will! Look at Toronto and Vancouver, for years they seemed unstoppable and now they’re experiencing tougher market conditions. Long story short, if you speak to a real estate professional or economist who says that our market is bullet proof, well I am sorry as they’re just dead wrong. In short, our market has had another amazing year and now that we are entering a period of stabilization we will likely begin to see the market slow down in the later months of the year. Here is a chart below that I have often shared in the past that illustrates “showing activity”, which I believe is a good measure of consumer confidence and general market activity across different months of the year:   2024 has been a huge success so far for our Realty Aces team and we truly owe it to our followers, supporters, brokerage, family and clients. We were named the top team in Alberta for Q2 as you’ll see below and it’s because of our support system. We strive to break barriers and to be the best real estate team each and every day, we simply don’t believe in average or the status quo. Some may call us aggressive in our attitude, nature and ambition to tackle every challenge, but we just call it our passion and if it’s a bit aggressive sometimes then so be it, we are in this to be the best at serving our clients, nothing else. Hopefully everyone is having an awesome summer and don’t forget that August is one of the best months of the year to get outside, enjoy your family, plan that BBQ or that hike that you’ve been putting off and just ensure that you’re living your best life for the remainder of summer! Cheers, Justin

|

July 2024 Market Update

| Hi Friends, |

| Welcome to the dog days of summer, arguably one of the best times of year! Not only do we have clarity on the real estate market and its trajectory for 2024 (as mentioned in last month’s newsletter) but we also get to enjoy a beautiful Canadian summer.

On July 24th there will be another Bank of Canada interest rate announcement. I would personally be surprised if we experienced a rate cut larger than 0.25% but of course they may surprise us. Assuming there is a small rate cut this will continue to help buyers who are on the sidelines to find affordable housing (which is a crisis at the moment). The problem for many buyers is that the market has increased again this year and most of the property price gains have been achieved for the year, so these buyers are now paying much higher prices versus 6-months ago. As mentioned last month, most communities have achieved a new benchmark price and with our market being historically seasonal it’s in my opinion that we will see little in terms of further gains to home prices in 2024. We have reached the summit and we will be here for 2024 until we enter a new market in 2025. I say this because our market is seasonal and the month to month “Sales Volume” will continue to decrease from now until December, which means there are less sellers and less buyers entering the market for the next 6 months. This does not mean our market will nose dive, it simply means less buyers and sellers will transact in the 2nd half of 2024. Out on the front lines I am seeing the market activity slow down, which is no surprise after a busy spring market. This is seasonal and expected when we hit July and many people opt to go enjoy Canadian summer, as they should! We are still seeing bidding wars and still selling homes very quickly and we are still setting new records in many communities, however, it’s not as hectic or competitive as it was over the past 3 months of spring market. This means that PRICING CORRECTLY is incredibly important in today’s market. It’s always important, but understanding that we have achieved the price gains (or most of them) for 2024 is critical to price your property right. Buyers have been through the trenches the past 3 months and they know what is a fair price, and what is a highway robbery price. Pricing correctly is one thing, but also having a strategic plan on how you’re going to sell your property in a market which isn’t as hot as the spring market is incredibly important. As the years roll by our industry keeps evolving, but unfortunately the overall quality of many listings lacks a strategic plan with a data based timeline to execute on and sellers are the victim of leaving money on the table. For buyers you are going to have less options moving forward but also less buyers to compete against, so it is relative. If you need a home then there is no better time than now to get into one before we will see the numbers of listings decline in the fall. Here is a graph that I’ve previously shared in past newsletters that I believe illustrates how our market is seasonal and the sales volume will slowly but surely decline as the year progresses towards December:   As you’ll see below our small team of Local Realty Aces had a smoking busy spring with our clients. Thanks to our clients, friends, family and all of our supporters that continue to support us as we continually evolve as a top team of Real Estate Professionals. We truly love what we do and we love that you love how we do it. Please ensure that you take advantage of this summer weather, take a break if you need it and remember that it’s summer in Canada, get outside and enjoy yourself! Cheers, Justin |

The past 3 months served as an amazing Spring Market for our clients – congrats below to you all on your spring real estate success stories! |

|

June 2024 Market Update

| Hi Friends, |

Yes it’s true, our market has once again reached the summit and new pricing has been established in our local real estate market.

Most communities have achieved a new benchmark price and with our market being historically seasonal it’s in my opinion that we will see little in terms of further gains to home prices in 2024. We are at the top and we will be here for 2024 until we enter a new market in 2025.

I say this because our market is seasonal and the month to month “Sales Volume” will continue to decrease from now until December, which means there are less sellers and less buyers entering the market for the next 6 months.

Many sellers prefer to take advantage of the spring market when we have the largest number of buyers in the market.

Additionally, families with kids want to achieve their real estate goals in conjunction with their kids’ school schedules. Meaning that a move between the end of June and the end of August is preferred, before school begins again in Sept. This means most of these families looking to make that particular transition have already made the decision to do so and have likely already sold and/or purchased, or they are about to.

July 1st forward we always see the market slowdown because of this cyclical trend above and to be clear, this does not mean that our market will take a nosedive. In fact, prices will remain stable and some sub-markets that are lagging may still see slight increases. After all, we have an incredibly low inventory of properties available, therefore the market will remain sizzling hot until this balances out.

So what does this mean for you?

If you’re selling then there will be less buyers in the market July 1st forward and the pricing has been established, so although the price will be right for you, it might take a bit longer to find that right buyer versus in a hot spring market when buyers are more motivated due to increased buyer competition. This is when it is critical that you’re working with a pro who will maximize return on your hard earned property with a strategic listing plan.

If you’re buying then there will likely be less competition versus in the spring. However, you’re now paying peak 2024 prices. It’s a trade off.

To touch on one of the main recent headlines of the Bank of Canada announcing a 25 basis-point (0.25%) decrease during their June 5, 2024 announcement. Contrary to what many may believe, the effect of the rates will not have an immediate impact, however, the impact is coming, very soon.

As mentioned in a newsletter a few months back, as rates begin to fall, this will eventually allow more buyers to enter the market, adding more fuel to our already chaotic market. The problem for these new buyers is that our market in 2024 has reached peak pricing (in most communities) and so waiting for a lower interest rate may have been appealing but you’re now paying late 2024 prices versus early 2024 prices.

Lower rates will also make renters feel like purchasing a home is possible again. However, just because the Bank of Canada is making decreases, this does mean that the lenders who give out mortgages will immediately begin making large interest rate drops. Speaking with mortgage brokers they all have the same narrative that it will take time to see lending rates fall enough to make a large impact on what buyers can afford.

To summarize, yes rates are going to fall and yes this will allow buyers a larger budget. But what we need to be aware of is that we are just beginning to go down this road and it will take time. As we progress through 2024 and see potentially more rate cuts the market will begin to take shape for 2025.

That being said, here is a prediction of mine for 2025.

Please remember I do not have a crystal ball but let’s consider this thought for a moment….. If rates fall throughout 2024 as projected and we still have a housing supply issue come early 2025 (which is likely), then the lower rates will be the fire that allows our market to go wild again in 2025. Obviously there are many variables to consider when predicting our market 6+ months from now, however, I just want to point out that lower lending rates on the horizon will certainly be a major variable that shapes our market next year.

Over the past month our small team was fortunate to have record numbers once again and we are succeeding due to your continued support. THANK YOU for continuing to follow us, support us and challenge us to be the best real estate professionals in the business. We are Your Local. Realty. Aces!

We don’t need to wait until it’s official next week, summer is here folks, so get outside and enjoy it with your family and friends. I know that I will be BBQing tonight!

Cheers,

Justin

May 2024 Market Update

| Hi Friends, |

| Our local real estate market is moving at an incredible pace and the dynamics of it are very complex. In this month’s newsletter I want to tackle a few interesting themes I am seeing in the market THAT MAY SURPRISE YOU!

Yesterday I spoke with a respective real estate professional in the Toronto region and he made it very clear that their market is quite unhealthy at the moment and sales are not surging like they once did. Although the year started out okay, in April things went sideways and right now they’re in an extremely volatile market. They do not have stability. If you google the Toronto Real Estate Market then you’ll be bombarded with headlines such as “The party is over” and “Prepare for financial instability”. The lesson for us here is that we will eventually see a bust just like Toronto is right now. Yes, it won’t be this year but it WILL HAPPEN and this is significant for all of us Albertans because we need to ensure we’re purchasing and selling real estate strategically to protect our largest assets. Another SHOCKING thing happening in our local market is what some developers and builders are doing. I will not name names but I can confirm that SOME developers (not all of them) are selling their new builds almost exclusively to Toronto Realtors/Buyers and paying them a higher commission than they would to a local agent who lives and works here. Why is this happening? The simple answer is GREED. And it’s unethical in my opinion. These developers in our local market, yes right here, not all of them but some, are selling their new builds to these buyers in Ontario via Ontario Realtors and paying them a higher than normal commission. They’re doing this because the Ontario agents and buyers DO NOT KNOW what a fair market value would be for these properties and they’re typically paying a much higher price. The developers are chasing these higher sale prices to unbeknownst Ontario buyers/agents. This is crazy. Not only does this prop up the prices in our local market but it also makes it incredibly hard for a local buyer, a local Albertan who NEEDS A HOME, to purchase a home. Again, I straight up think that it is unethical and although it appears to be legal, I would argue there is a lack of integrity here and the local Albertans are the ones who suffer. Here is a chart from CMHC (Canadian Mortgage & Housing Corporation) showing the housing starts. Therefore, if you consider many of these are going right into the hands of non-local buyers then we are in for a storm until we can correct this.

And as mentioned in previous newsletters, the interprovincial migration to Alberta is staggering. Check out this Statistics Canada chart and headline

If you’re hoping to trade up into a more expensive home then you need to buy now because it’s only going to get harder and more expensive as this market chugs along into summer. If you’re happy with your property then stay put and enjoy this newsletter to take in the chaos that is happening out on the front lines! If you’re not in the market as a homeowner but you’d like to be, then it’ll only get harder for you as time passes and prices increase. Sorry if that seems harsh, it’s simply the truth though. Investors, choose wisely because with limited inventory you need to hedge your bet strategically. And just buying up property without buying strategic properties comes with great risk as this market will cool off. I do not believe that we will defy the law of economics and I do believe a bust will happen at some point! So there is a lot to unpack here and without diving down a rabbit hole, let me summarize by saying that our market is extremely hot right now and there are some incredibly interesting variables driving it that you may or may not have been aware of. Our team had a dynamite April helping many buyers and sellers achieve their real estate goals and we thank you for continuing to support Your Local Realty Aces at Grassroots Realty Group. We are on pace to sell more properties than any previous year and it’s truly because of all of you who continue to support and trust in us as your preferred local real estate professional. We are off to a busy May already and are looking forward to seeing many of you soon. I hope that you’re enjoying this sunny spring weather today! Cheers, Justin |

April 2024 Market Update

| Hi Friends, |

| 106.1 Radio Station reached out to ask my opinion and foresight on our local real estate market and I was surprised when during the interview the media reporter asked me to elaborate on why I said “we are an affordable market to many buyers,” she seemed kind of pissed off that I said that.

I don’t know why but the scene with Jack Nicholson in “A Few Good Men” came across my mind “You Can’t Handle The Truth!”. Of course I shot the truth back to her in a more pleasant way and it was well received. But the truth is, I think many of us locals can’t handle the truth of what is happening in our real estate market. And I totally get it, this is a wild market. Well, the truth is that we all need to accept what is happening to our market and the fact is that the migration of out of province buyers has totally changed the game. Our real estate does not seem affordable any longer to us long term residents who have been here for years or decades, however, the market and these new buyers do not care what we think. They simply do not care and why would they? Sorry if that’s too candid but it’s the truth and I would rather shoot it to you straight than fluff it up. Many of these buyers can sell their home for 3 times as much in their out of province market and come purchase a similar property here for 1/3 of the price. Also, this is an awesome place to live and the rest of Canada has realized it – we are no longer a hidden gem, we are the gem everyone wants. That is what I mean by “our market is affordable” AND these buyers will continue migrating here into 2025 (and likely beyond) so our market will continue to be in a Seller’s Market until there are enough homes available for the Buyers. Simple economics – supply and demand. I do not think we’re going to defy economics long term; there will be a downturn and we will have a balanced market and eventually a buyer’s market. I can say with confidence that it won’t be in 2024. I think we’re likely to be in a growth market for at least the next year, until they’re able to build enough homes in Airdrie, Calgary and Canada in general, to house the entire population. It truly is a housing crisis. Interest rates held on April 10th and I actually think that this is a good thing for the time being which may surprise you. Don’t get mad at me for saying that! The truth is that it’s an absolute bloodbath out there right now for buyers and we are seeing multiple offers on nearly everything our Realty Aces team is listing right now. For example: We listed a property last week at a fair market price and we had 26 showings in less than 2 days and multiple offers, eventually selling 5.5% above list price. 1 of 26 buyers got the property. 25 are still out there searching, to put it into perspective………Therefore, if we lower interest rates and make it so EVEN MORE BUYERS can now purchase, then we’re adding more buyers to a market that already does not have enough supply of homes. So although I certainly understand that lower interest rates will help buyers be able to purchase more, I would also argue that lowering rates too much or too soon will add too many more buyers back into the market too soon, inherently pouring fuel on a red hot market that is already breaking records for activity. I also believe we’ll see multiple interest rate drops in 2024 and would be shocked if we do not see one on the next announcement, June 5th. Here is what the Calgary Real Estate Board Chief Economist had to say about our market in March: “We have not seen March conditions this tight since 2006, which is also the last time we reported high levels of interprovincial migration and a months-of-supply below one month. Moreover, we are entering the third consecutive year of a market favouring the seller as the two-year spike in migration has driven up demand and contributed to the drop in re-sale and rental supply. Given supply adjustments take time, it is not a surprise that we continue to see upward pressure on home prices.” I like to stay apolitical because I honestly don’t care which political party anyone supports, that is your personal choice. What I will say though is that the price of real estate in Canada right now is astronomical compared to just a few years ago and I think this is going to spark some major political changes and policies, in my opinion. I am personally excited to see politicians battle it out in the coming months and coming year to see who can find a solution to our real estate crisis. And just day to day affordability in general. Again I don’t care which party that you cheer for, but I predict that real estate will be a main topic of discussion moving forward because simply put, housing is pretty darn important – this has to be talked about more when so many people can’t afford a home! Our team had the best first quarter of sales ever and it’s thanks to all of our loyal supporters like you. We sincerely appreciate you and we will continue to work hard every day to ensure our clients are delivered the 5 star service we pride ourselves on. Below are some highlights from the past month and also some hot new listings! Spring is here, get outside and enjoy the fresh air! Have a great April everyone. Cheers, Justin |

March Market Update Interview with 106.1FM:

https://discoverairdrie.com/articles/airdrie-tops-home-sales-outshining-neighbours

March 2024 Market Update

| Hi Friends, |

| Spring market arrived a month early this year and there is absolute PANIC in the air for many who have been caught off guard. It’s really no surprise that the market is as sizzling hot as it is because the data over the past few months projected this market perfectly.

This is problematic for long term residents who are not currently in the market or who have been shell shocked with the rise in their monthly rent. When I explain to people in person how hot the market is, nearly everyone says “that must be great for your business”. The answer is that it actually makes my business much harder! A hot market is great as we break records with our sellers, but it’s two-fold. We also have buyers and it’s extremely tough to navigate this market. Hence why we always have a detailed plan specific to each client. Long story short, I would rather a market that is more balanced that gives opportunity to BOTH the buyers and the sellers. Right now it’s super one-sided in favour of the sellers. Which is great for them, but at the end of the day the way that I see it is that there are humans on both sides of these transactions and it’s really tough for the buying side right now and I feel for them. There is always more than enough real estate business to do in ANY TYPE OF MARKET. Therefore, I dream of a more balanced market where the pressure is more manageable. I miss those days! But for now it is full steam ahead and our team is getting all of our buyers into great homes every week! I’ve also had many clients asking me lately, “why are there so many new communities and new homes popping up?” or “Who is going to buy all of these new homes?” The answer is that yes we have an aggressive number of new home starts happening right now and for longtime residents it is mind boggling how many new communities are popping up. Check this out: